My US Stock portfolio for the month of May ended up in RED but the good thing is it’s just down by -0.52%.

However, my portfolio is up by 7.67% between January to May. And if we add the first 3 days of the month of June, we’re up by 9.68%.

Portfolio Comparison to the S&P 500 Index

As of post time, the S&P 500 Index is up by 11.53%. This means that we’re not able to beat the market just yet since my portfolio is 2% lower than that of the S&P 500 Index.

If only I’d invested solely in VOO (which tracks the S&P 500 Index), I would get the same YTD percentage. But since I have other ETFs and individual stocks in my portfolio, it’s expected that my average return would be different.

This a classic example of the saying “You can’t beat the market all the time”.

Portfolio Breakdown

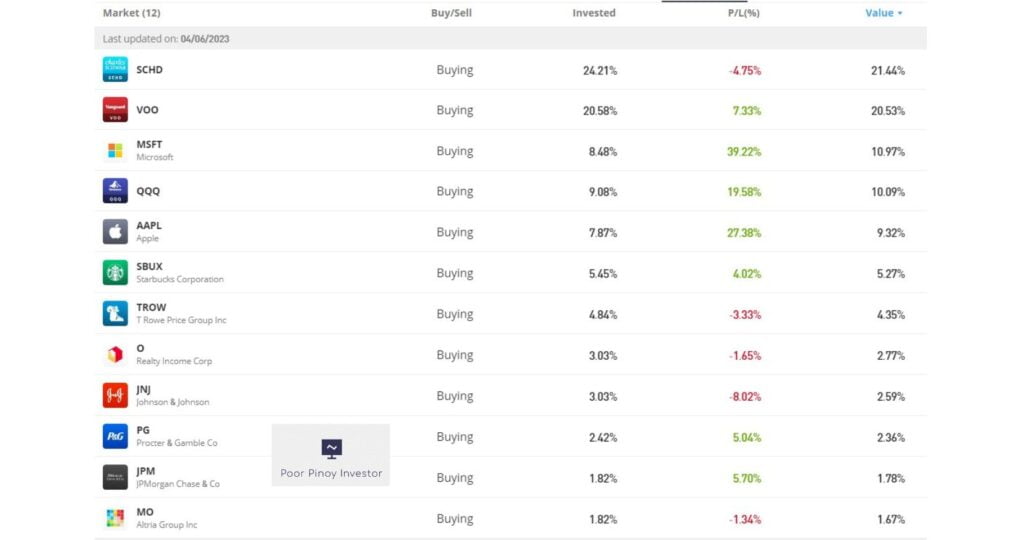

To better understand why we were not able to beat or at least be at par with the S&P 500 Index, we need to take a closer look at my portfolio.

As you can see, SCHD which is the largest holding in my portfolio took a beating this year and is currently in the RED. Though we have others that are also on “paper” loss, SCHD accounts for the lower YTD performance compared to that of the S&P 500 Index.

Am I concerned about SCHD?

No, not really. If you noticed, the ones with a high percentage return in my portfolio are growth stocks (including growth ETF: QQQ) while most dividend stocks are in the red. Since SCHD is a dividend ETF, it follows suit that the performance is not quite as good as we expect.

Changes to Portfolio Allocation

Though I’m not concerned about the future of SCHD, I still made an adjustment to the distribution of my portfolio. And this is what I came up with:

- Both VOO and SCHD will have a 25% allocation

- QQQ would get 11%

- For Individual stocks, I’ll allocate 10% to Microsoft and 9% to Apple

- The rest will each have anywhere between 2-5%

So 61% of my investment is nestled under the 3 ETFs while the remaining 39% is invested in individual stocks. And though all of them will earn dividends, you can see that those tech/growth companies comprise a big chunk of my portfolio.

Portfolio Reveal

Perhaps you’re wondering how big or small my investment is at eToro. Here’s a screenshot of my account:

Investment Journey

- I started investing in the US Stock market on September 9, 2022

- Total deposits made to eToro: $1641

- Total net dividends received: $10.85

With the current market value and including net dividends earned, my P/L is actually $136.06 which is an increase of 8.29% of my total principal investment.

Kuya Well’s Corner

At first, I decided not to post the exact amount of my investments when I do portfolio reveals like this and will just show the percentage of the stocks and ETFs that I own. The reasons for my initial decision are the following:

- Readers may not believe the posts I’m uploading if they see that I’m only a small-time investor

- Safety concerns since we’re talking about the actual values

That said, I guess I have to put my money where my mouth is. Also, the name of this website is Poor Pinoy Investor. So expect that I’m not a big shot and that most people will relate to my investment journey but hopefully avoid my mistakes and be inspired by what I do.

Though, for now, hanggang US stocks portfolio lang muna ang irereveal natin. Saka na muna sa other investments (crypto, mutual funds, MP2 and PSE).

“Wow! Investing in real estate in the Philippines sounds like a dream come true! The stunning landscapes, vibrant culture, and promising economic growth make it an irresistible opportunity. I can already envision the serene beachfront properties and luxurious urban developments that await. Count me in for an unforgettable investment journey!”