Managing your salary can feel overwhelming, especially when bills, savings goals, and unexpected expenses keep piling up. If you often wonder where your money went before the next payday, then the 50-30-20 rule might be the budgeting formula you need.

This simple yet effective method can help you gain control over your finances while still allowing room for fun and flexibility. And yes—this works perfectly for Filipinos, no matter your income level.

What is the 50-30-20 Rule?

The 50-30-20 rule is a budgeting method that splits your income into three categories:

- 50% for Needs – These are your essentials, like rent, utilities, food, transportation, insurance, and minimum debt payments.

- 30% for Wants – These cover lifestyle choices, such as dining out, entertainment, shopping, hobbies, or travel.

- 20% for Savings & Debt Repayment – This portion goes to your savings, investments, emergency fund, or paying extra toward debts.

It’s a straightforward way to make sure your money is working for you—covering necessities, enjoying life, and building your future.

Step-by-Step Guide to Budgeting Your Salary with the 50-30-20 Rule

1. Know Your Take-Home Pay

Always base your budget on your net income—that’s your salary after taxes, SSS, Pag-IBIG, PhilHealth, and other deductions. If your gross salary is ₱25,000 but your take-home pay is ₱22,000, use ₱22,000 as your starting point.

2. Calculate Each Category

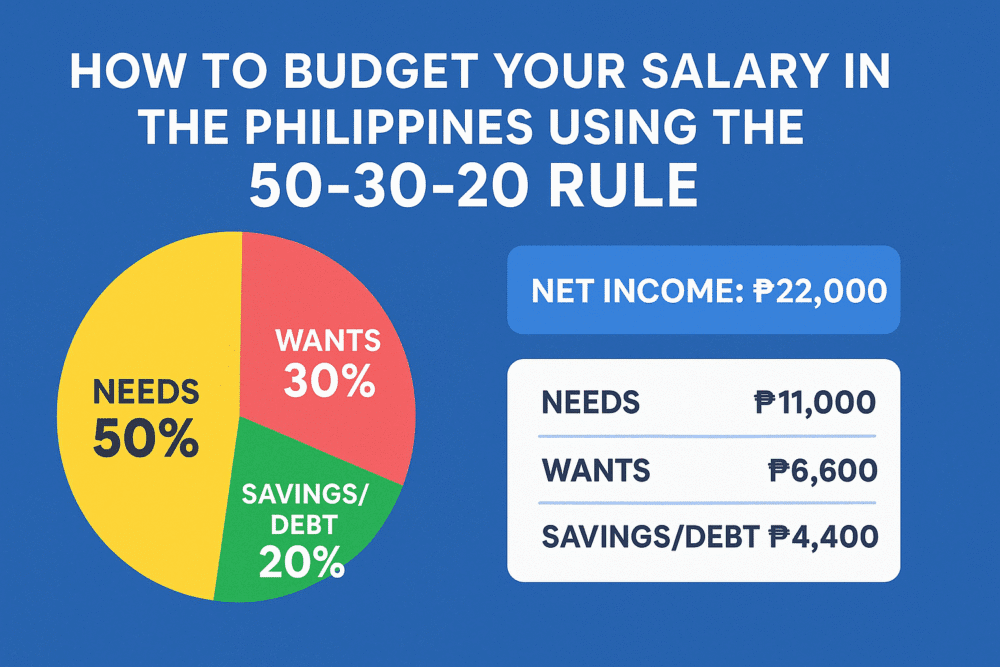

Let’s say your net income is ₱22,000. Here’s how the 50-30-20 rule would look:

- Needs (50%): ₱11,000

- Wants (30%): ₱6,600

- Savings/Debt (20%): ₱4,400

3. List Your Actual Expenses

Write down all your fixed and variable expenses for the month. Compare them to the ideal allocation above. If your needs exceed 50%, look for ways to cut costs or adjust your wants category.

4. Automate Your Savings

If possible, move your 20% savings right after payday to a separate bank account. This way, you won’t be tempted to spend it.

5. Be Flexible

The 50-30-20 rule is a guideline, not a rigid law. If your needs are slightly higher (like 55%) because of rent or school tuition, adjust your wants category accordingly. The important thing is to prioritize savings as much as possible.

Why the 50-30-20 Rule Works for Filipinos

- Easy to Remember – You don’t need complex spreadsheets or apps.

- Balances Life and Future – You still get to enjoy your hard-earned money while securing your financial future.

- Adaptable to Any Income Level – Whether you’re earning minimum wage or six figures, the percentage-based approach works.

Sample Budget Table (Net Income: ₱22,000)

| Category | Percentage | Amount | Examples |

|---|---|---|---|

| Needs | 50% | ₱11,000 | Rent, utilities, food, transport |

| Wants | 30% | ₱6,600 | Dining out, movies, shopping |

| Savings & Debt | 20% | ₱4,400 | Emergency fund, MP2, extra debt pay |

Blogger’s Corner

I know budgeting can feel restrictive at first—lalo na if you’re used to spending without tracking. But the beauty of the 50-30-20 rule is that it gives you structure without completely cutting the fun out of your life.

The key is discipline. If you stick to this formula, even just for a year, you’ll notice you’re not only covering your needs but also growing your savings faster than before. And trust me—your future self will thank you for it.