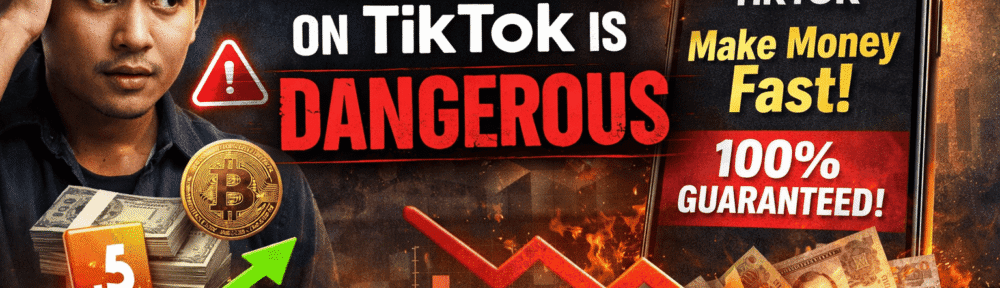

TikTok has become one of the most popular places where Filipinos get financial advice. A 30-second video tells you how to grow ₱10,000 into ₱1 million, escape the rat race, or earn passive income while you sleep.

The problem is simple.

Most of that advice is incomplete, misleading, or outright dangerous.

Not because money topics are bad, but because TikTok’s format rewards confidence and virality, not accuracy.

TikTok Rewards Confidence, Not Correctness

On TikTok, the algorithm does not care if advice is:

- mathematically sound

- realistic for Filipinos

- suitable for beginners

It cares about:

- bold claims

- emotional hooks

- shocking numbers

That is why videos saying “I made ₱500,000 in 3 months” outperform videos explaining emergency funds, risk management, or realistic returns.

Financial advice becomes entertainment. Accuracy becomes optional.

“Just Do This” Advice Ignores Context

Most TikTok finance creators never tell you:

- their age

- their starting capital

- their income stability

- whether they failed before succeeding

A strategy that works for:

- a single person with no dependents

- someone with offshore income

- someone who already has capital

can be financially disastrous for:

- a breadwinner

- someone with debt

- a minimum-wage earner

Yet TikTok advice is often presented as one-size-fits-all.

Finance does not work that way.

Survivorship Bias Is Everywhere

You see:

- the one crypto trader who got lucky

- the one dropshipper who hit it big

- the one stock picker who timed the market

You do not see:

- the many who lost money

- the silent quitters

- the wiped-out portfolios

TikTok shows winners only. This makes risky strategies look safe and common.

This creates a dangerous illusion.

“If they can do it, why can’t I?”

Because you are not seeing the full picture.

Risk Is Almost Never Mentioned

Watch closely and you will notice:

- no downside discussion

- no worst-case scenarios

- no mention of capital loss

Everything is framed as low risk, safe, or guaranteed.

In real investing, high returns always come with risk.

If risk is missing from the explanation, you are being misled.

Many Creators Are Selling Something

Some sell:

- courses

- Telegram groups

- referral links

- mentorship programs

Others sell validation, lifestyle envy, or the dream itself.

Even when they say “I’m not selling anything,” many are building a brand, an audience, or future monetization.

That does not automatically make them bad people. It does mean their incentives may not be aligned with your financial safety.

Short Videos Kill Nuance

You cannot properly explain:

- asset allocation

- compounding risks

- long-term planning

- behavioral finance

in 30 to 60 seconds.

So creators simplify.

Oversimplification in finance is dangerous.

Real money decisions require context, trade-offs, and patience.

TikTok thrives on speed, not depth.

Copying Financial Moves Is Not a Strategy

A common TikTok pattern goes like this.

“This is what I invested in. Copy it.”

But:

- you do not know their full portfolio

- you do not know their risk tolerance

- you do not know if they already exited

Copying moves without understanding the reasoning is gambling, not investing.

How to Use TikTok Without Ruining Your Finances

TikTok is not useless. It should be treated as idea generation, not instruction.

Before acting on any financial advice, ask:

- What is the downside?

- Who does this not work for?

- What assumptions are being made?

- Is this realistic for my income and obligations?

If those questions are not answered, do not move your money.

Blogger’s Corner

TikTok did not make Filipinos financially illiterate. It made bad advice louder.

The most dangerous financial advice is not the obviously fake ones.

It is the advice that sounds smart, looks confident, and skips the risks.

Real wealth is built slowly and unglamorously.

Unfortunately, that does not go viral.

If you want financial progress, avoid creators who promise speed.

Follow those who explain reality, even when it is boring.