Seabank offers a high-yield savings account where you can earn 4.5% interest per annum on your deposits (first 250 thousand). The fraction of the interest per annum on your deposited money is credited on a daily basis (usually between 12MN – 12:10 AM).

Brief Background

Seabank is a registered Rural bank in the Philippines which you can confirm on the Bangko Sentral ng Pilipinas website. It is under Sea Limited which has a headquarters in Singapore and is currently listed on the New York Stock Exchange (stock code: SE).

If you haven’t guessed yet, Shopee is also a part of Sea Limited. Another business under Sea Limited is Garena. Yup, the online games developer and publisher company.

How to Open an Account with Seabank?

Creating an account is relatively easy. Simply do the following:

- Download the Seabank app on Google Playstore for Android, AppGallery on Huawei devices, and App Store for iOS.

- Select your sign-up option: Shopee, Mobile number, and Apple ID (for iOS devices).

- Next, you’ll need to undergo a facial verification.

- Upload your valid ID and fill out your personal details. And that’s it.

Benefits of having a Seabank Account

- Higher earnings interest rate per annum – it’s currently at 4.5% per annum which is 80 times higher than that of a commercial bank that offers 0.0625% p.a. Note that the 4.5% rate is applicable only up to 250K. Any amount beyond that will earn 3% interest p.a. instead.

- The interest amount is credited daily to your account (between 12MN and 12:10 AM). To make it simple, you will get 0.0123% interest on your current account balance.

- Compounding effect – since you get daily interest, you’re actually earning more than 4.5% per annum due to compounding.

- No minimum balance requirement to earn interest, unlike commercial banks that require a certain amount before you can start earning their measly interest.

- No maintaining balance, unlike commercial banks where you get penalized if you go below their minimum maintaining balance.

- No dormancy account fees. However, if your account is dormant for 2 years, it will no longer earn interest.

- You can have up to 15 free transfers (no transaction costs) every week. This refreshes every Monday.

- Deposits are insured by PDIC up to 500K per depositor.

Additional Benefits

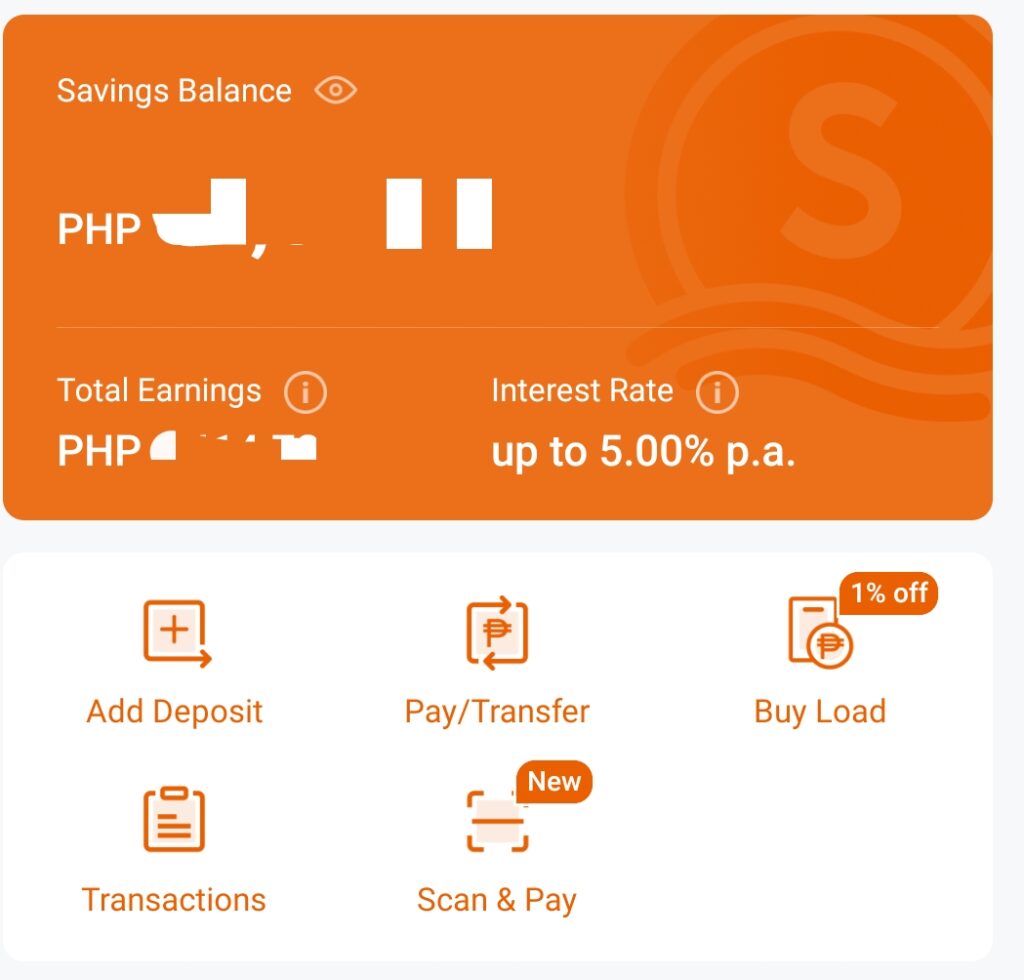

The Seabank app allows you to do the following transactions:

- Buy Load

- Buy goods/services from merchants with QR PH code

Cons

- They don’t provide ATM cards. So in order for you to cash out, you’ll need to transfer the amount to a 3rd party bank account where you have the means to cash it out.

- Though they have physical banks/branches (since it’s a Rural bank), you can’t go to those banks for your concerns regarding the app or your transactions even. It’s not necessarily a “cons” per se since it’s not expected for a digital bank to accommodate support concerns through a physical bank. That said, I’ve added it here since there are depositors who are still enamored by a physical bank that they can go to when they have concerns.

Anyway, for any account concerns, you can use the live chat support on the app or contact them via email: contact@cs.seabank.com.ph. You can also call their local hotline at (+632) 8891 7927 or their local toll-free number (for PLDT landline and Smart mobile) which is 1800-1-110-2957.

What else to consider?

Just like any other bank (including Digital banks like Maya or CIMB), there’s a 20% tax deducted from your earnings interest.