Digital banking in the Philippines has grown rapidly, giving Filipinos more ways to save, spend, and earn interest on their money. Two of the most popular options today are MariBank and Maya Bank. But if we focus purely on banking features, which one gives you the best value? Let’s break it down.

1. Account Types and Requirements

MariBank

- Offers a single savings account with no maintaining balance.

- Minimum initial deposit: ₱100.

- Fully digital — no need to visit a branch.

- Requires valid ID and personal details for KYC.

Maya Bank

- Offers both a digital savings account and a Maya Current Account (debit-enabled).

- No maintaining balance for most accounts.

- Fully digital onboarding in minutes.

- Requires valid ID and proof of address.

✅ Winner: Tie. Both banks allow quick, fully digital account creation with minimal requirements.

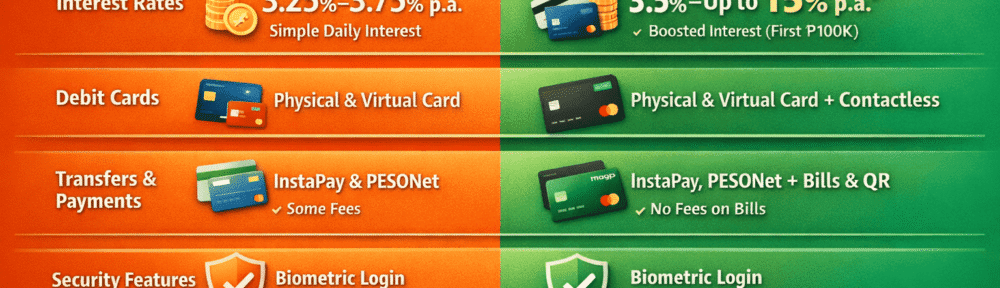

2. Interest Rates and Earnings (Updated for 2026)

MariBank

- Savings earn 3.25% p.a. for balances up to ₱1,000,000, and 3.75% p.a. for balances above ₱1,000,000.

- Interest is credited daily based on your previous day’s balance.

- Simple, predictable rates — no extra conditions. (maribank.ph)

Maya Bank

- Offers a 3.5% p.a. base interest rate on all balances.

- Potential to boost up to 15% p.a., but boosted interest applies only to the first ₱100,000 and requires completing app activities like bill payments, card usage, or QR transactions.

- Interest is credited daily, calculated on your daily balance. (mayabank.ph)

📊 Takeaway: Maya can give a much higher return if you complete the boost requirements, while MariBank gives a steady, predictable rate with no extra steps.

3. Transfers and Payments

MariBank

- Supports InstaPay and PESONet transfers.

- Can link to e-wallets like GCash or Maya.

- Some transactions may incur fees depending on the method.

Maya Bank

- Supports InstaPay, PESONet, and QR payments.

- Allows bill payments, merchant payments, and wallet top-ups, often with no fees.

- Maya’s app is a full payment ecosystem beyond just transfers.

✅ Winner: Maya. More versatile for everyday payments.

4. Debit Cards and ATM Access

MariBank

- Offers both physical and virtual debit cards.

- Works nationwide at ATMs and online.

- Supports online and international payments; some international transactions may have fees.

Maya Bank

- Offers physical and virtual debit cards.

- Supports contactless payments and online subscriptions.

- Free ATM withdrawals up to a monthly limit; extra withdrawals have small fees.

✅ Winner: Tie. Both now have virtual and physical card options, but Maya still has contactless payment perks.

5. Security Features

MariBank

- Biometric login (fingerprint/face ID) for app access.

- Two-factor authentication (2FA).

- Card lock/unlock from the app.

- Transaction alerts via app notifications or SMS.

Maya Bank

- Biometric login and 2FA.

- Instant virtual card creation and deletion for safer online spending.

- Fraud detection alerts for suspicious activity.

✅ Winner: Tie. Both banks now have strong security features, including biometric login and virtual cards.

6. Overall Pros and Cons

| Feature | MariBank | Maya Bank |

|---|---|---|

| Account Opening | Fast, fully digital, single savings account | Fast, fully digital |

| Interest Rate | 3.25–3.75% p.a., daily compounding | 3.5% base p.a., up to 15% boost (first ₱100K) |

| Transfers | InstaPay/PESONet | InstaPay/PESONet + bills, merchants, wallets |

| Cards | Physical + virtual | Physical + virtual, contactless |

| Fees | Some transfers may have fees | Generally lower fees, more free transactions |

| Security | 2FA, biometric login, card lock | 2FA, biometric login, virtual card, fraud alerts |

Blogger’s Corner

Both MariBank and Maya Bank are strong choices for digital banking in 2026. Your decision depends on priorities:

- Choose MariBank if you want predictable savings growth without extra app tasks.

- Choose Maya Bank if you want a flexible digital ecosystem with savings, payments, and potential high-interest boosts.

💡 Pro tip: If you can regularly meet Maya’s app activity requirements, the boosted interest can outperform MariBank’s rates, but MariBank is better for worry-free, long-term saving.