GCash is a mobile wallet and online payment platform in the Philippines that allows users to pay bills, buy load, send money, make purchases online, and more.

Features of the GCash app

Bill Payments

You can use the app to pay your bills for electricity, water, cable, internet, and more.

Mobile Load

Buying prepaid load for yourself or others is made easy by the app.

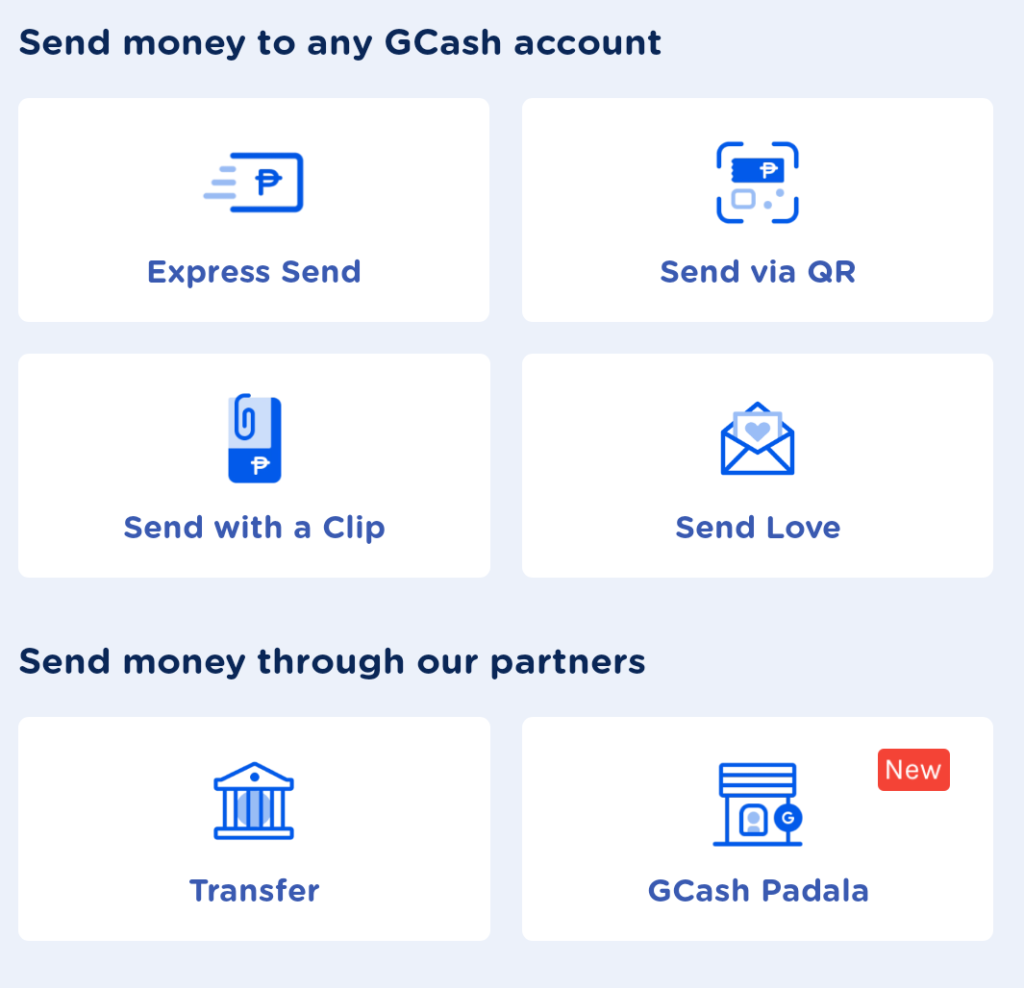

Send Money

Send money to other users or to any mobile number in the Philippines.

Online Shopping

Due to partnerships with various online merchants, you can purchase online using your GCash wallet. Though the app has its own Shopping section, you can also pay for your purchases on other online shopping apps like Shopee, Lazada, and Shein using GCash as the payment method.

QR Payments

Go cashless and pay for your stuff in physical stores by scanning the QR codes using the app.

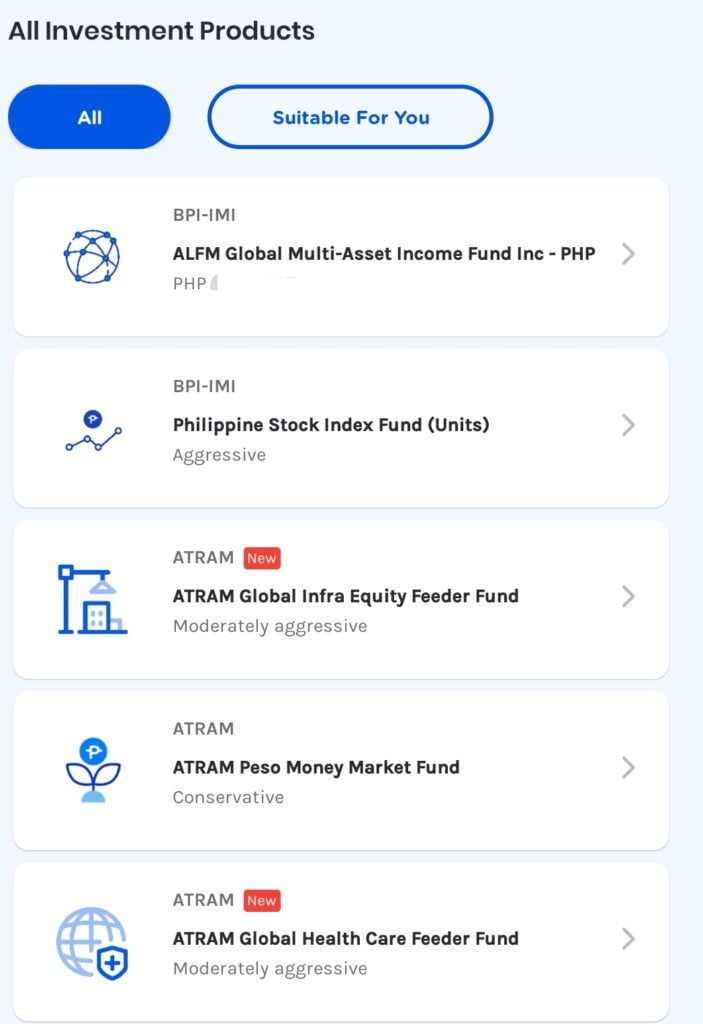

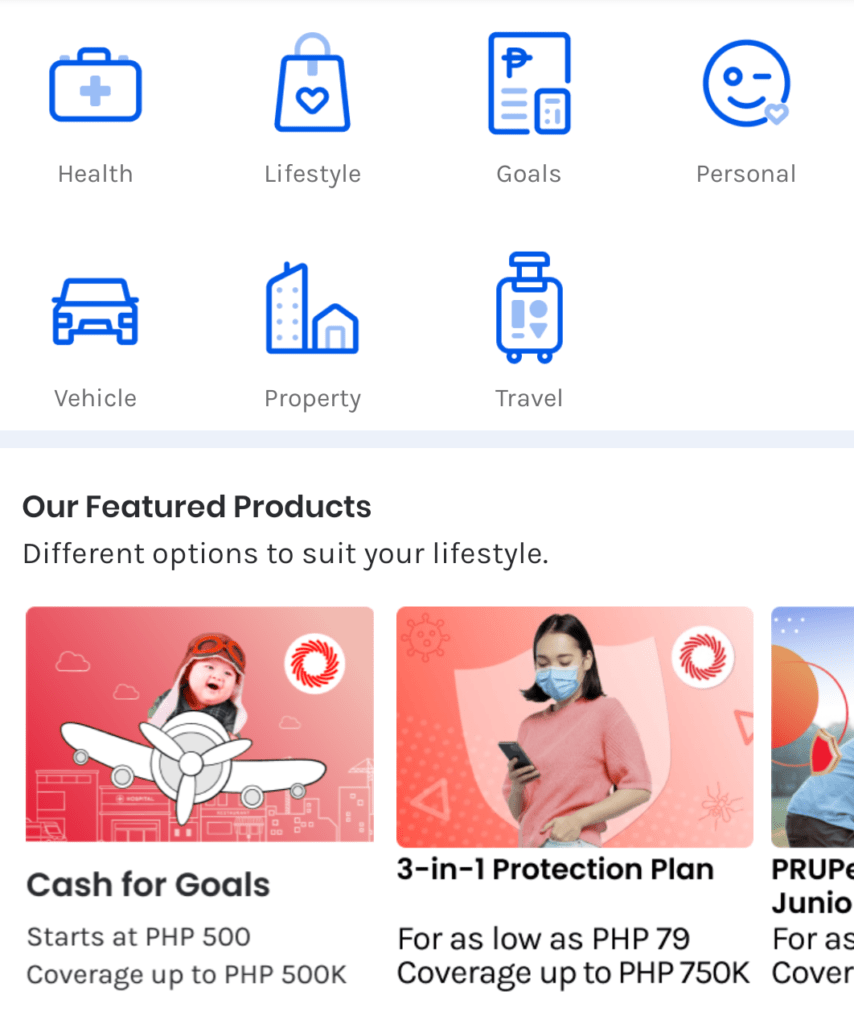

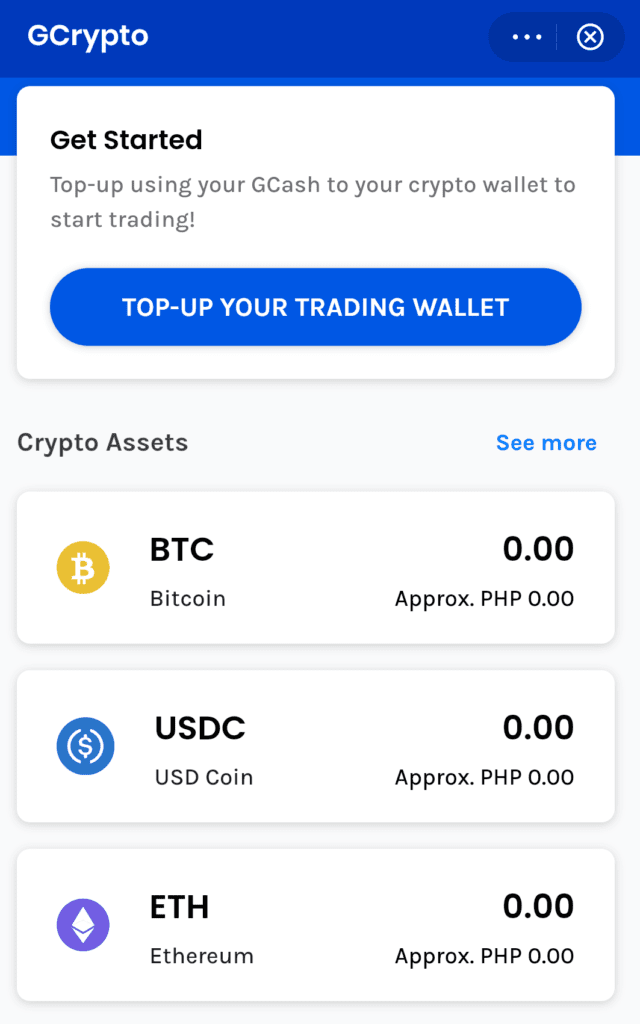

Investments

Investing made easy! You can now invest in mutual funds, cryptocurrency and even buy insurance using your mobile wallet.

Note: Global GStocks and GStocks PH are currently not available yet. There’s no specific date as to when they will be released.

Remittances

GCash has partnered with international money transfer services to allow users to send money abroad.

Signing up for GCash

- Scan the QR code below or click here to start the registration process.

- Download the GCash app from the App Store or Google Play Store.

- Launch the app and select “Sign Up”.

- Enter your personal information such as your full name, mobile number, and email address.

- Verify your mobile number through an SMS verification code.

- Create a password and secure it with a 4-digit MPIN.

- Read and agree to the terms and conditions.

- Complete the verification process, which may include providing a government-issued ID, selfie, and proof of address.

Cashing in on GCash

- Open the GCash app and tap on the “Cash In” button.

- Choose your preferred cash-in method, such as bank transfer or over-the-counter (OTC) at a partner outlet.

- Enter the amount you want to cash in and follow the instructions to complete the transaction.

- Wait for the cash to be credited to your GCash wallet, which usually takes a few minutes to an hour.

In conclusion, GCash is a highly convenient and user-friendly app that allows you to easily manage your finances on your smartphone. With its various features, including the ability to pay bills, buy load, send money, and more, ithas become a popular choice for many Filipinos looking for a simple and reliable way to manage their finances.