A time deposit is one of the simplest and safest ways to grow your money in the Philippines. Banks offer a fixed interest rate over a specific term — and the longer your money stays, the higher the rate you usually get.

But here’s the catch: earnings are subject to a 20% final withholding tax. This calculator will help you see exactly how much you’ll earn net of tax, based on the bank method for computing time deposit interest.

Time Deposit Calculator

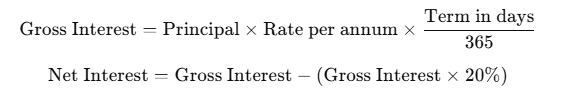

Formula banks use:

Bank Standard Days per Term:

| Term (Months) | Days Used in Bank Computation |

|---|---|

| 1 month | 30 days |

| 2 months | 60 days |

| 3 months | 91 days |

| 6 months | 182 days |

| 12 months | 365 days |

| 24 months | 730 days |

| 36 months | 1095 days |

| 60 months | 1825 days |

Free Time Deposit Calculator

Philippines Time Deposit Calculator

Results:

Example Computation

If you deposit ₱100,000 in a 6-month time deposit at 3% p.a.:

- Days: 182

- Gross Interest: ₱1,493.70

- Less 20% Tax: ₱298.74

- Net Interest: ₱1,194.96

- Maturity Value: ₱101,194.96

Pros & Cons of Time Deposits

✅ Pros:

- Guaranteed returns, no market risk

- Covered by PDIC up to ₱500,000

- Fixed interest regardless of market changes

⚠️ Cons:

- Lower returns compared to stocks, mutual funds, or MP2

- Early withdrawal penalties apply

- Earnings subject to 20% withholding tax

Tip: If you want higher returns and can tolerate a bit more risk, consider Pag-IBIG MP2 Savings or Retail Treasury Bonds as alternatives.