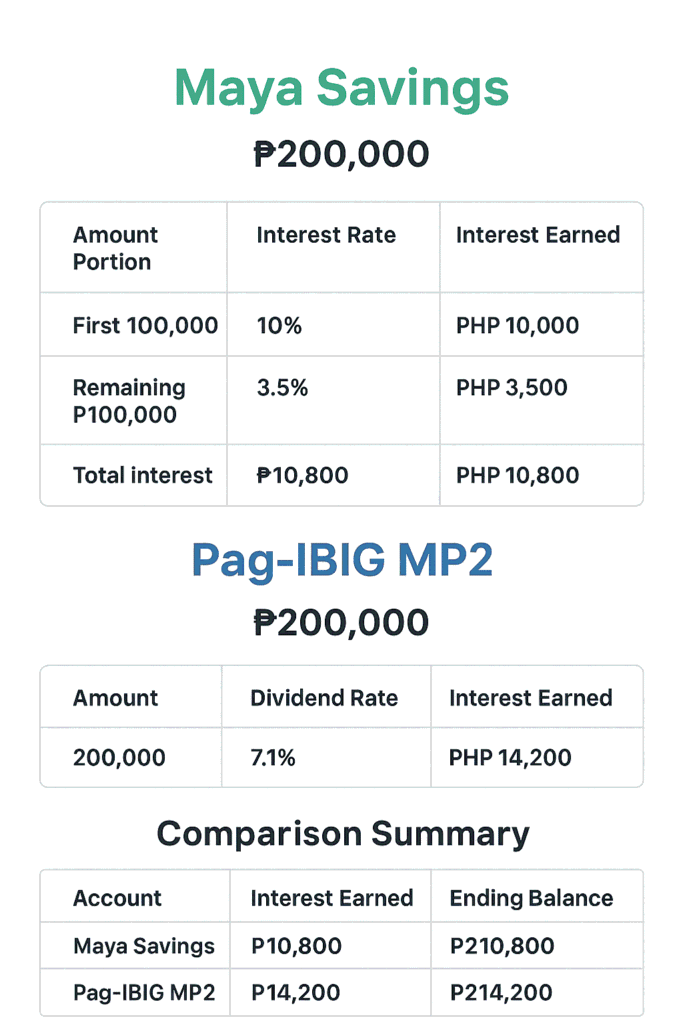

When choosing where to place excess cash, many Filipinos end up deciding between Maya Savings and Pag-IBIG MP2.

At first glance, Maya looks more attractive because of its high advertised interest rate. MP2, on the other hand, does not promise fixed interest but offers tax-free dividends applied to all deposits.

To understand which one makes more sense, you need to look past the headline numbers.

How Maya Savings Interest Really Works

Maya Savings has two different interest rates applied to your balance.

Boosted Interest (Up to 10% p.a.)

Maya offers up to 10% per annum interest, but this only applies to the first ₱100,000 of your savings balance and only if you meet the required conditions.

Any balance within the ₱100,000 cap can earn the boosted rate once qualified.

Base Interest (Above ₱100,000)

Any amount beyond ₱100,000 earns only the base interest rate, which is currently 3.5% per annum, regardless of whether you qualify for boosted interest.

This means that even if you qualify for the 10% rate:

- Only the first ₱100,000 earns up to 10%

- All excess funds earn just the base rate

Tax on Maya Savings Interest

Interest earned from Maya Savings is subject to a 20% withholding tax.

This tax applies to:

- Both boosted interest

- Base interest

Your credited interest is already net of tax, but the tax still reduces your actual return.

How MP2 Dividends Work

MP2 operates very differently from a bank savings account.

Instead of interest, MP2 pays annual dividends based on Pag-IBIG Fund’s performance.

Key Characteristics of MP2 Dividends

- Dividends are tax-free

- The declared dividend rate applies to the entire MP2 balance

- There is no cap on how much can earn dividends

- Returns vary year to year, depending on fund performance

- Dividends are compounded annually within MP2

Whether your MP2 balance is ₱50,000 or ₱5,000,000, the same dividend rate applies to all of it.

Maya Savings vs MP2: Interest Mechanics Comparison

Interest / Returns

Maya Savings:

- Up to 10% p.a. on the first ₱100,000 (subject to conditions)

- 3.5% p.a. base interest on amounts above ₱100,000

- 20% tax on all interest earned

MP2 Savings:

- Dividend-based returns

- Dividend rate applies to the full balance

- Dividends are completely tax-free

Liquidity and Access to Funds

Maya Savings

- Funds can be withdrawn anytime

- Suitable for emergency and short-term needs

MP2 Savings

- Funds are locked in for the full maturity period

- Designed for long-term saving

- Not suitable for emergency use

Which Makes More Sense?

Maya Savings is more suitable if:

- You are saving below or around the ₱100,000 cap

- This is emergency or short-term money

- You value liquidity above maximum returns

MP2 is more suitable if:

- You are saving large amounts beyond ₱100,000

- This money is meant for long-term goals

- You want tax-free growth

- You prefer a hands-off savings approach

Blogger’s Corner

Maya’s 10% interest rate looks attractive, but it only applies to a limited portion of your savings — and is reduced further by taxes.

MP2 may not advertise flashy rates, but its tax-free dividends applied to the entire balance make a big difference over time.

Once your savings grow beyond the promo cap, the gap between the two becomes clearer.

High liquidity favors Maya.

Long-term growth favors MP2.

Understanding how interest is actually calculated matters more than the headline numbers.