Want to invest for retirement with zero tax on earnings? A PERA (Personal Equity and Retirement Account) is one of the best legal ways to do it in the Philippines — and ATRAM makes it possible to open one fully online.

Here’s a step-by-step guide on how to create your PERA account with ATRAM using just your phone and valid ID.

Who Can Open a PERA Account?

You’re eligible to apply if you:

- Are at least 18 years old

- Have a valid TIN (Tax Identification Number)

- Are earning income (employee, self-employed, freelancer, OFW, etc.)

- Own a Philippine bank account

- Can present a valid government-issued ID

Step-by-Step Guide to Opening Your PERA by ATRAM Account

Step 1: Download the PERA by ATRAM App

- Go to the App Store or Google Play

- Search for PERA by ATRAM

- Install the app on your phone

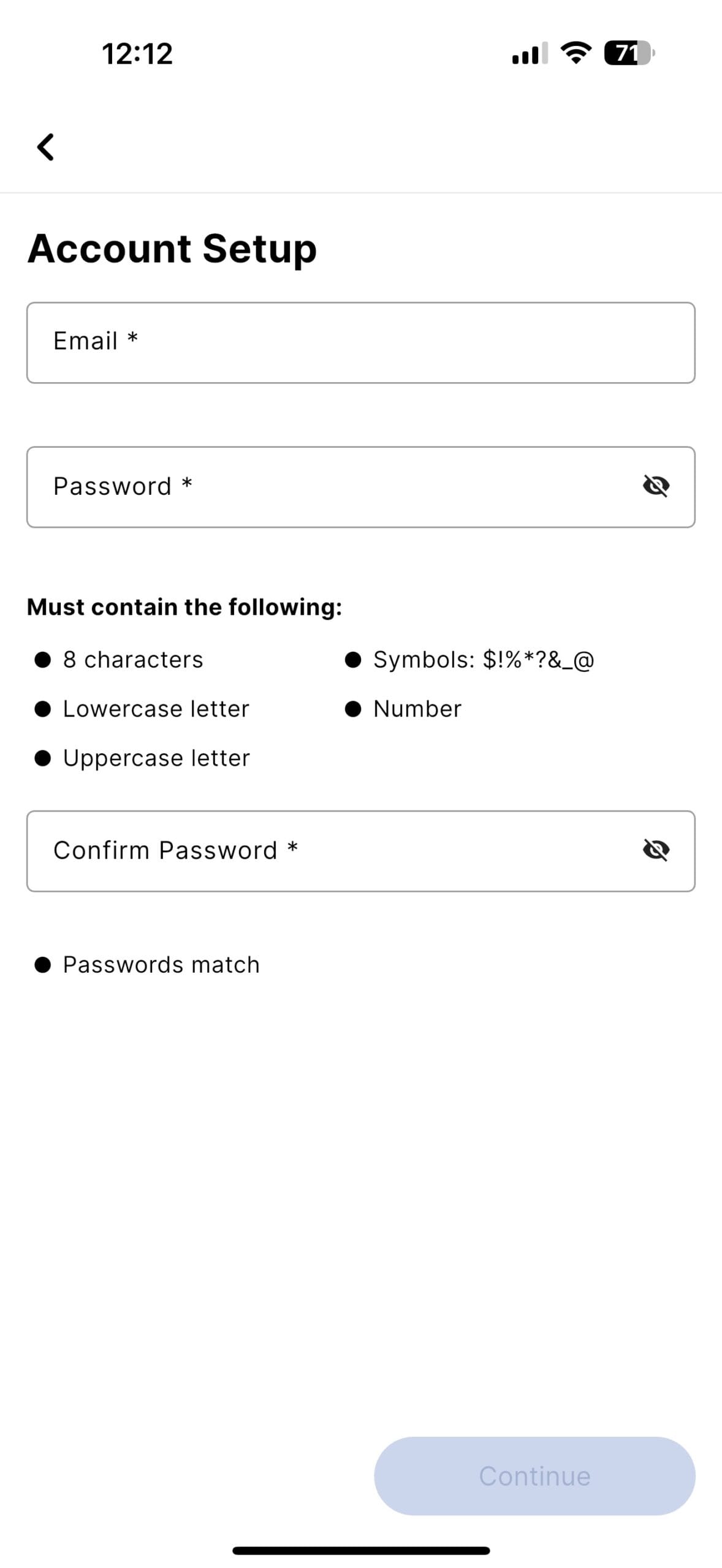

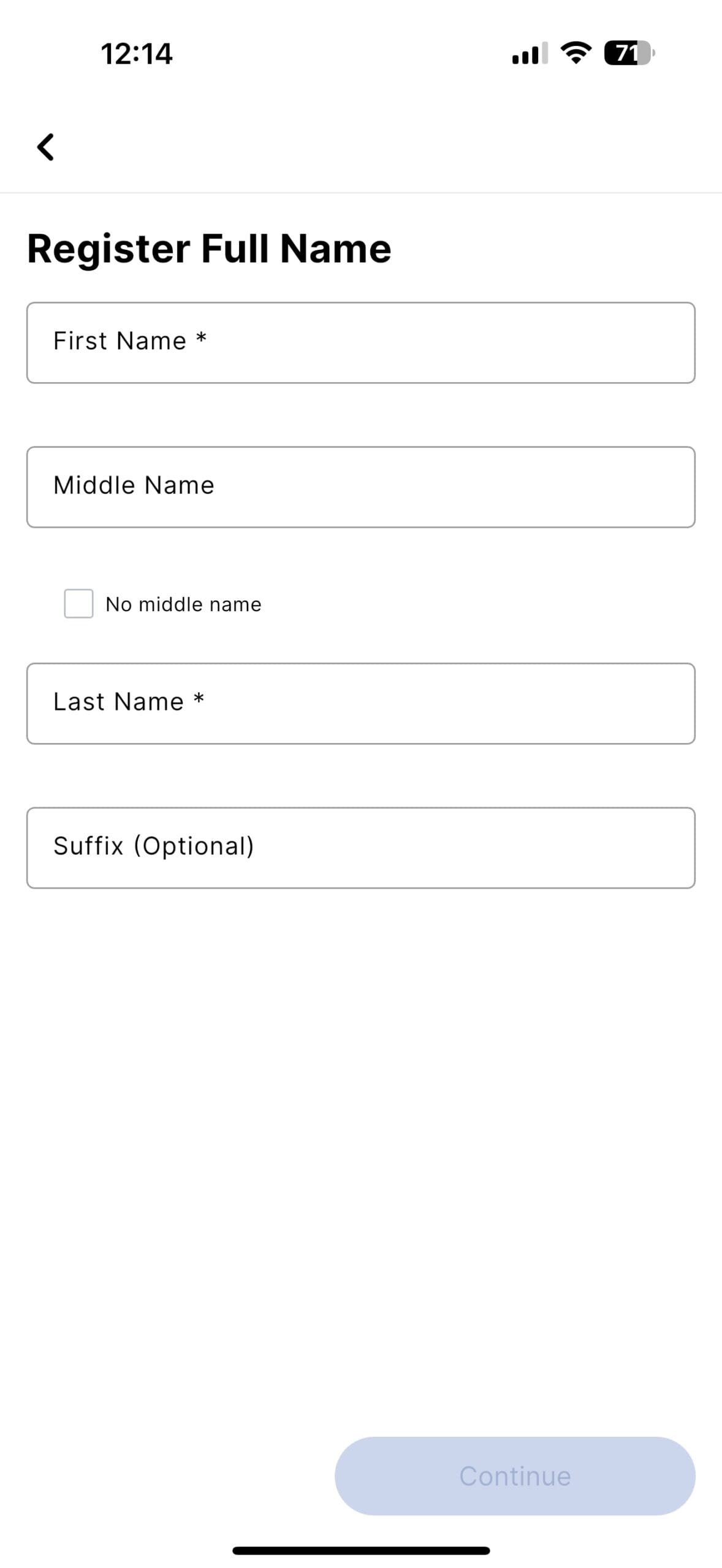

Step 2: Create Your Account

- Tap Sign Up

- Provide the following:

- Full name

- Mobile number

- Email address

- Set and confirm your password

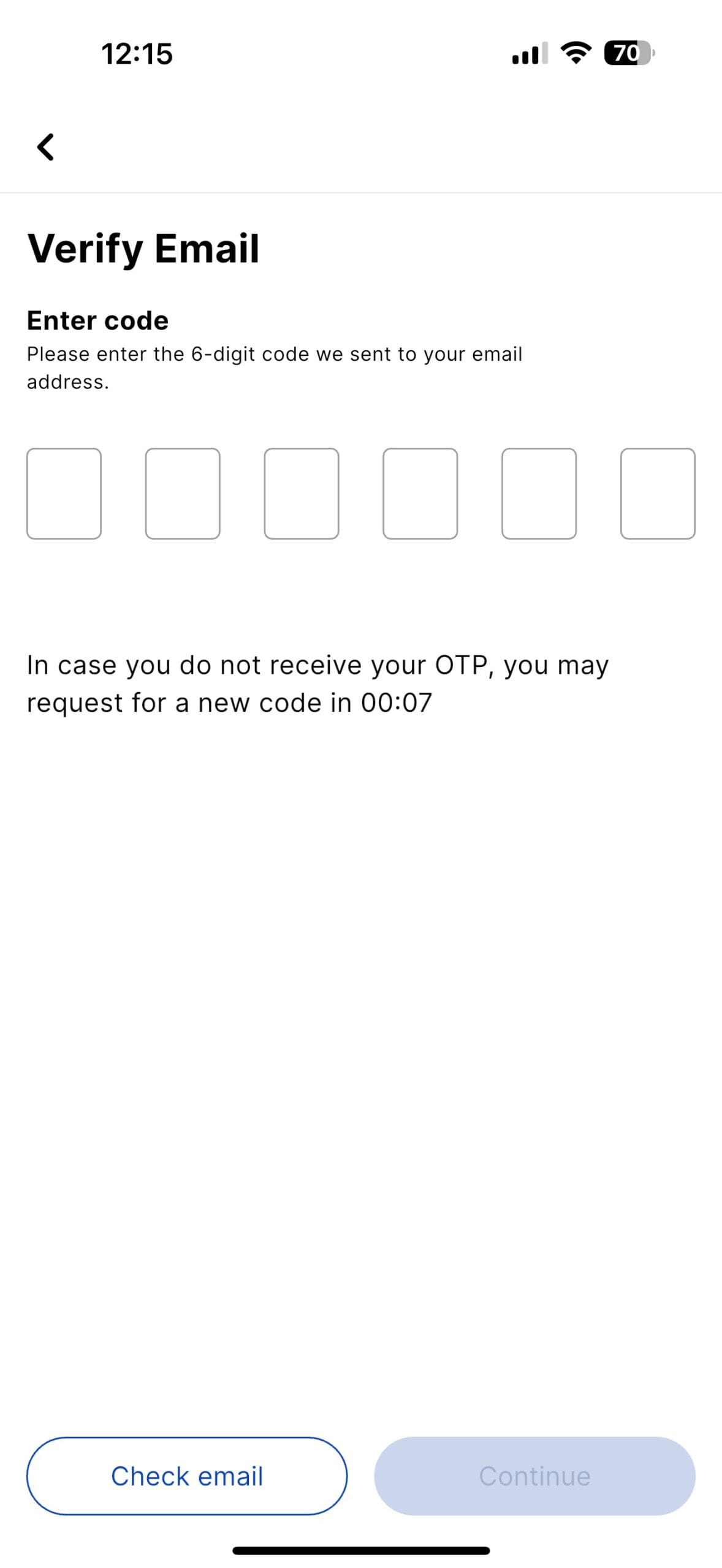

Step 3: Set Up 2-Factor Authentication

To secure your account, the app will prompt you to:

- Link your mobile number or authenticator app

- Input a verification code to activate 2FA

This is required before proceeding to the next steps.

Step 4: Take a Photo of Your Valid ID

You’ll be asked to capture your valid government-issued ID directly using your phone camera (upload from gallery is not allowed).

Accepted IDs include (but not limited to the following):

- UMID

- Driver’s License

- Passport

- National ID (PhilSys)

- Postal ID

- PRC ID

- SSS ID

Make sure your photo is clear and all corners are visible.

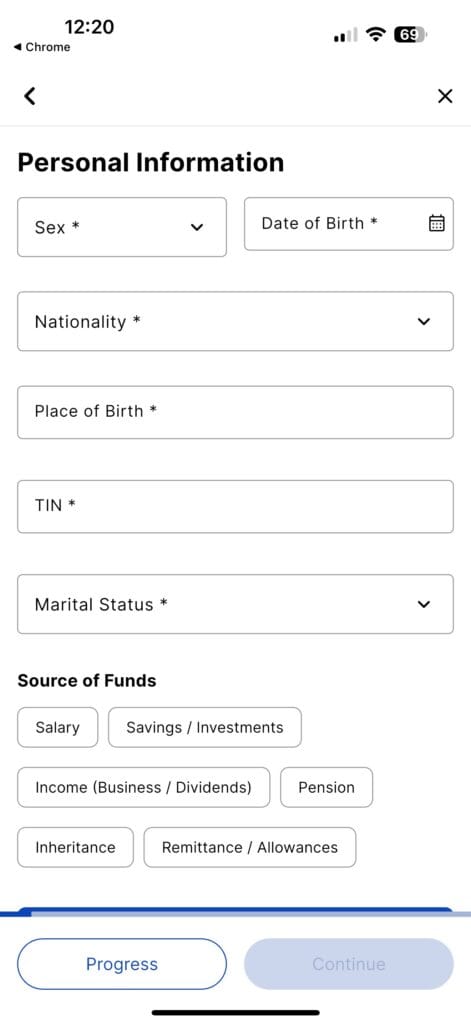

Step 5: Fill Out Personal and Employment Details

You’ll now complete several forms inside the app:

- Personal Information (birthdate, address, etc.)

- TIN (Tax Identification Number)

- Employment Status and occupation

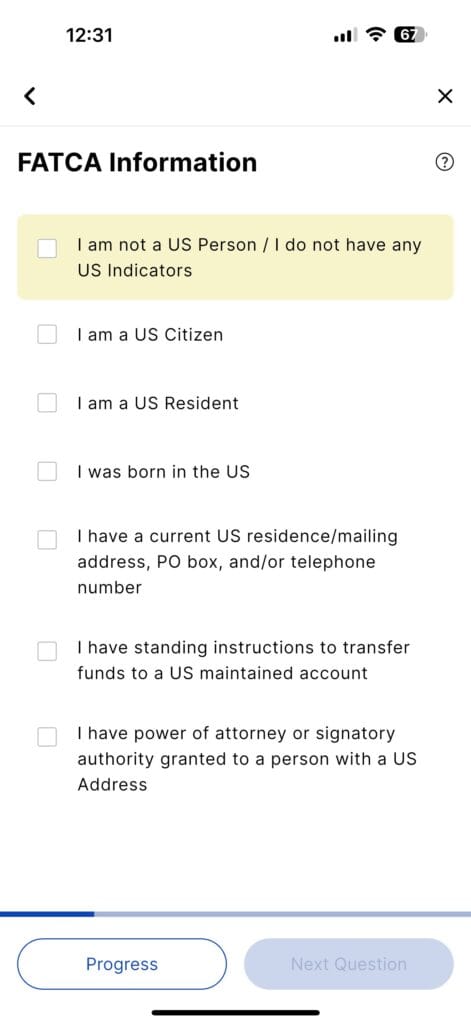

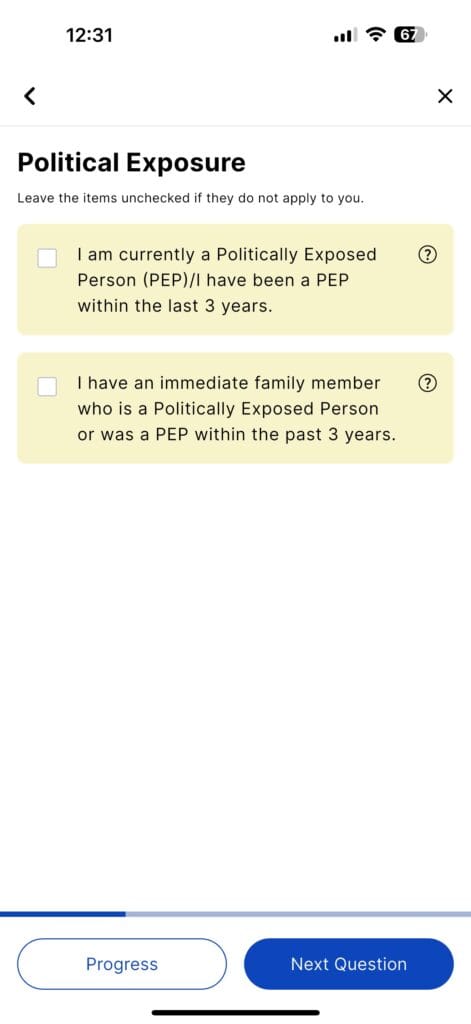

- FATCA Information (for tax compliance)

- Political Exposure declaration

Make sure everything matches your valid ID to avoid delays.

Step 6: Answer the Risk Suitability Questionnaire

This short quiz is required by BSP to help determine what type of fund suits you best.

You’ll be asked questions about:

- Your age and financial goals

- Your risk tolerance

- Your annual gross income

This helps identify whether you’re better suited for Money Market, Bond, or Equity Funds.

Step 7: Register Your Bank Account

You’ll then be asked to:

- Provide your bank account number

- Choose your bank from the list

This is where your future withdrawals or redemptions will be sent.

Step 8: Digitally Sign the PERA Administrator Agreement

Once all forms are completed, the app will show the PERA Administrator Agreement for you to review.

You’ll be prompted to sign it digitally inside the app to finalize your application.

Step 9: Confirm Your Application

Once you’ve filled out all the necessary information and signed the PERA Administrator Agreement, click the final Confirm button to submit your application.

Step 10: Wait for an Email and Schedule Your Video Call

After submitting, you’ll receive an email from ATRAM (usually within the day or next business day). This email will ask you to schedule a Zoom call — this is part of the mandatory face-to-face video verification required to finalize your account.

During the Zoom call, be ready to:

- Show your valid ID again

- Confirm your personal and financial details

- Answer a few questions related to your PERA application

Once that’s done, you’ll receive a final email confirming that your PERA account has been activated. From there, you can already start contributing!

What Happens After Approval?

You can now start funding your PERA account.

- Minimum investment: ₱1,000

- Contribution cap: ₱200,000 per year (₱400,000 for OFWs)

- You can fund via InstaPay, PESONet, or bank transfer

You’ll also be able to choose among PERA fund types:

- Money Market Fund – low risk

- Bond Fund – moderate risk

- Equity Fund – higher growth potential

You can switch funds later as your goals evolve.

Why Open a PERA Account with ATRAM?

- Fully digital application (no branch visit needed)

- Easy, guided onboarding process

- Low starting amount (₱1,000)

- Managed by ATRAM, a trusted investment company

- Contributions earn tax-free returns

- Get a 5% income tax credit every year based on your total contribution

Final Thoughts

Opening a PERA by ATRAM account is one of the smartest ways to start preparing for retirement — whether you’re in your 20s or nearing 40s. The process is 100% online and doesn’t require any complicated paperwork.

All you need is your TIN, valid ID, and a few minutes on your phone.

Start today while time is still on your side.