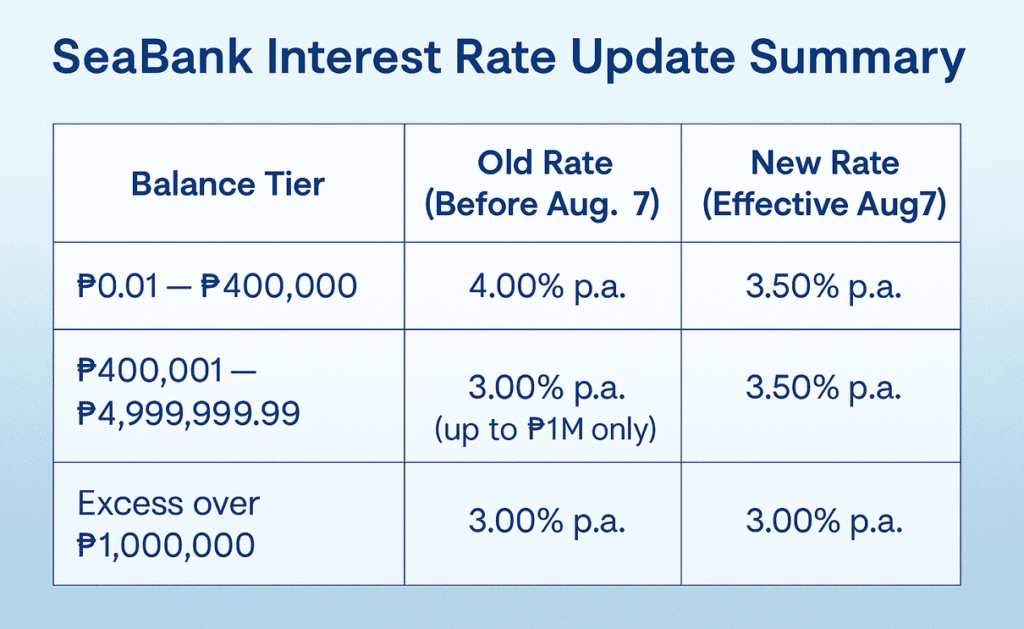

Heads up, SeaBank savers! Beginning August 7, 2025, SeaBank will implement a new interest rate scheme:

- 3.5% per annum for balances up to ₱1,000,000

- 3.0% per annum for balances exceeding ₱1,000,000

This change was officially announced by SeaBank on their Facebook page, and it affects all savings accounts starting August 7.

What Changed?

Previously, SeaBank offered:

- 4.0% p.a. on balances up to ₱400,000

- 3.0% p.a. for any amount beyond that

Now, while the headline rate goes down from 4% to 3.5%, the coverage increases—meaning more of your savings (up to ₱1 million) will earn the higher rate.

Sample Computation

Let’s say you have ₱1.2 million in your SeaBank account.

- First ₱1,000,000 earns 3.5% p.a.

- Remaining ₱200,000 earns 3.0% p.a.

That gives you a blended interest rate of roughly 3.42% per year.

Daily Crediting Still Applies

As with before, SeaBank will continue crediting interest daily, which means you’ll still enjoy compounding even if the base rate is slightly lower than before.

This is a big plus, especially for digital bank users who prefer to see their savings grow every day.

Is It Still Worth Saving with SeaBank?

Yes, kung ₱1M or below ang balance mo. You’re still getting 3.5% per annum, which is very competitive among digital banks today.

But if your funds are consistently above ₱1 million, then maybe it’s time to split your money across other high-interest banks like:

- Maya (up to 4%)

- Tonik (up to 4.5% with time deposits)

- GoTyme (3% base rate + bonus boosters)

Diversification na rin ‘yan.

Blogger’s Corner

SeaBank’s new rate structure is a mixed bag depending on how much you have saved.

For those with larger savings (₱500,000 to ₱1 million or more), this is actually a positive change. You now earn 3.5% p.a. interest on a bigger portion of your money—up to ₱1 million, compared to the old ₱400,000 cap.

Pero kung mas maliit ang savings mo, especially under ₱400,000, this update feels more like a downgrade. That’s because the rate dropped from 4% to 3.5%, meaning you’ll now earn slightly less interest per day than before.

So, what should you do?

If you’re nearing or exceeding the ₱1M mark, SeaBank is still a competitive choice. But if your balance is consistently below that, it might be worth checking out other digital banks that still offer 4% or more.

At the end of the day, it all boils down to how much you’re saving and how aggressive you want your returns to be.