You can now apply for BPI’s credit-to-cash via the app. So instead of going to the bank or calling BPI’s hotline, they’ve made it easier to apply.

Requirements before you can apply for a credit-to-cash with BPI

For you to be able to apply for a credit-to-cash via the BPI mobile app, you need to have the following:

- A BPI credit card with a substantial amount of balance (credit limit or madness limit)

- A BPI savings account where the amount will be deposited

Steps on how to apply for BPI’s credit-to-cash via the mobile app

Step 1: Log into your BPI mobile app and tap on your credit card account

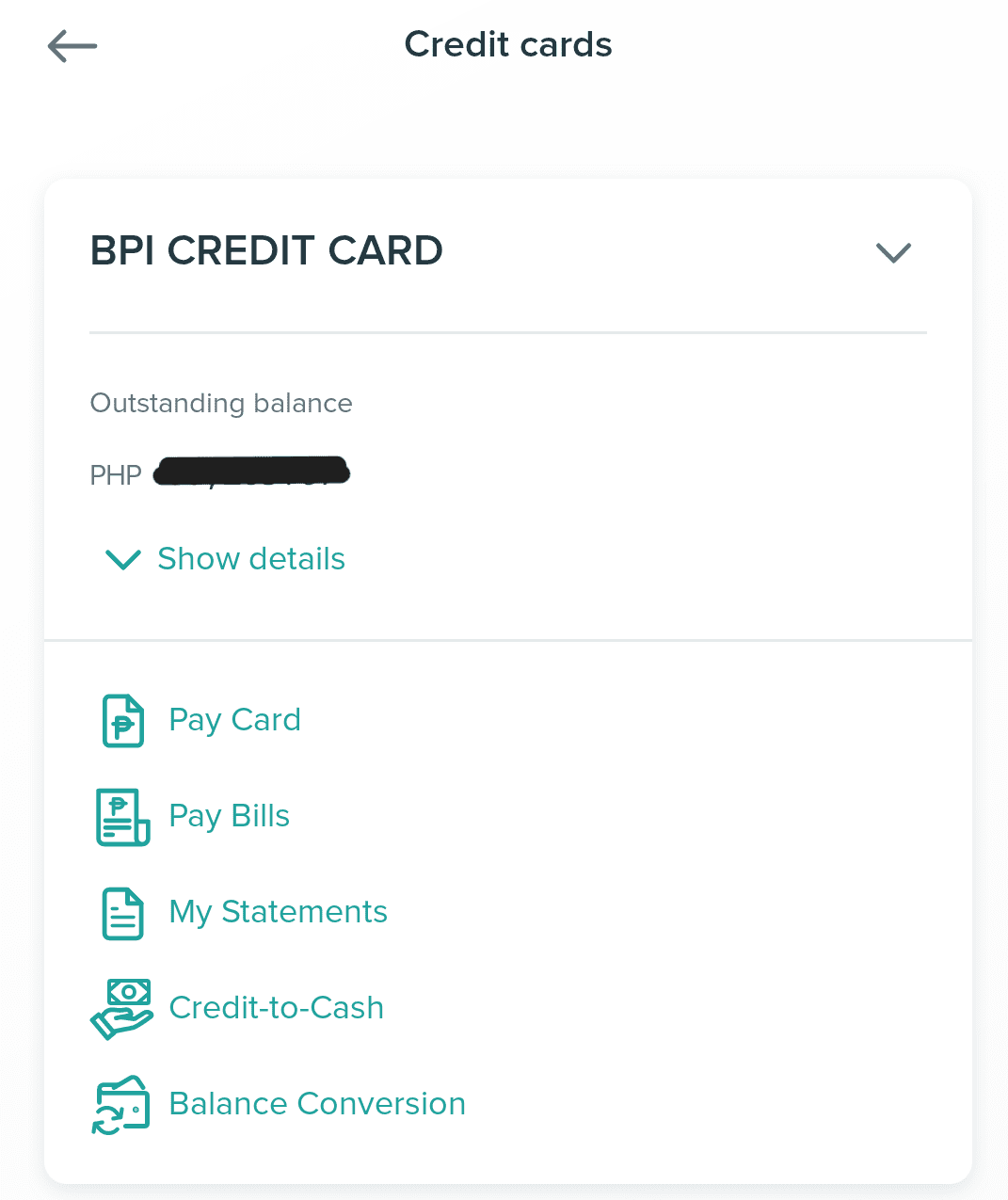

Step 2: Tap on Credit-to-Cash

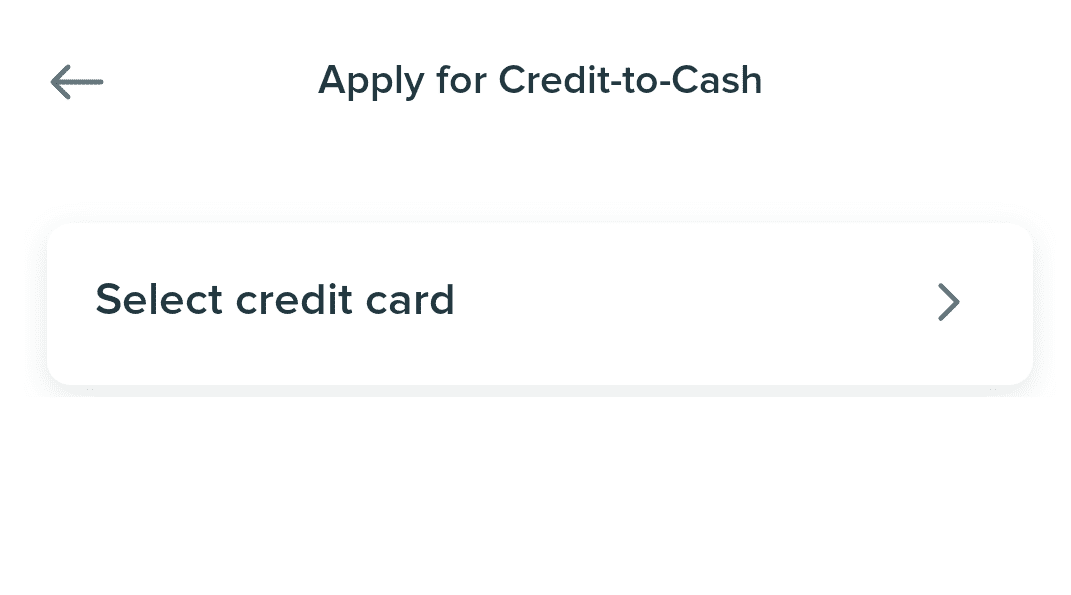

This will give you the option to choose your credit card account.

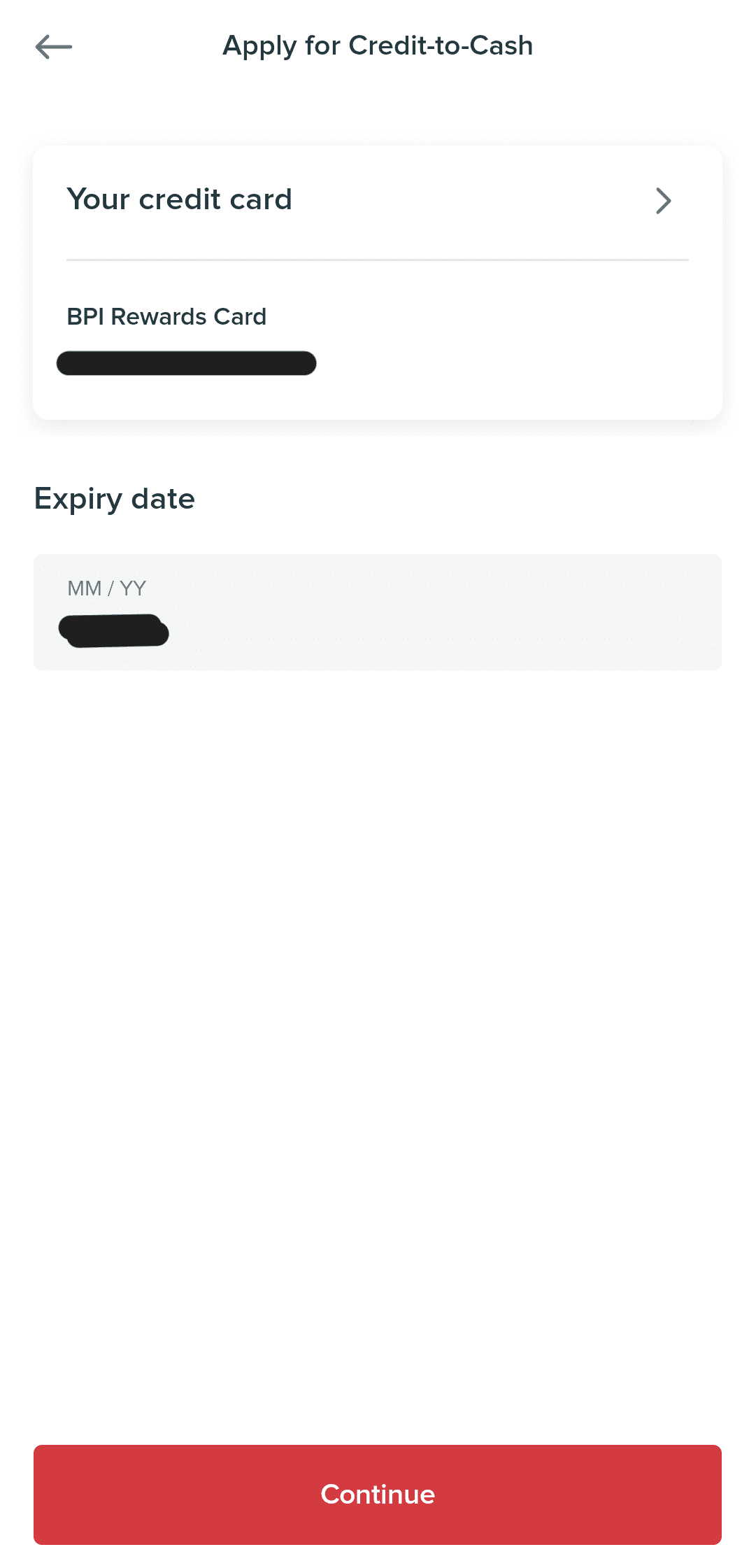

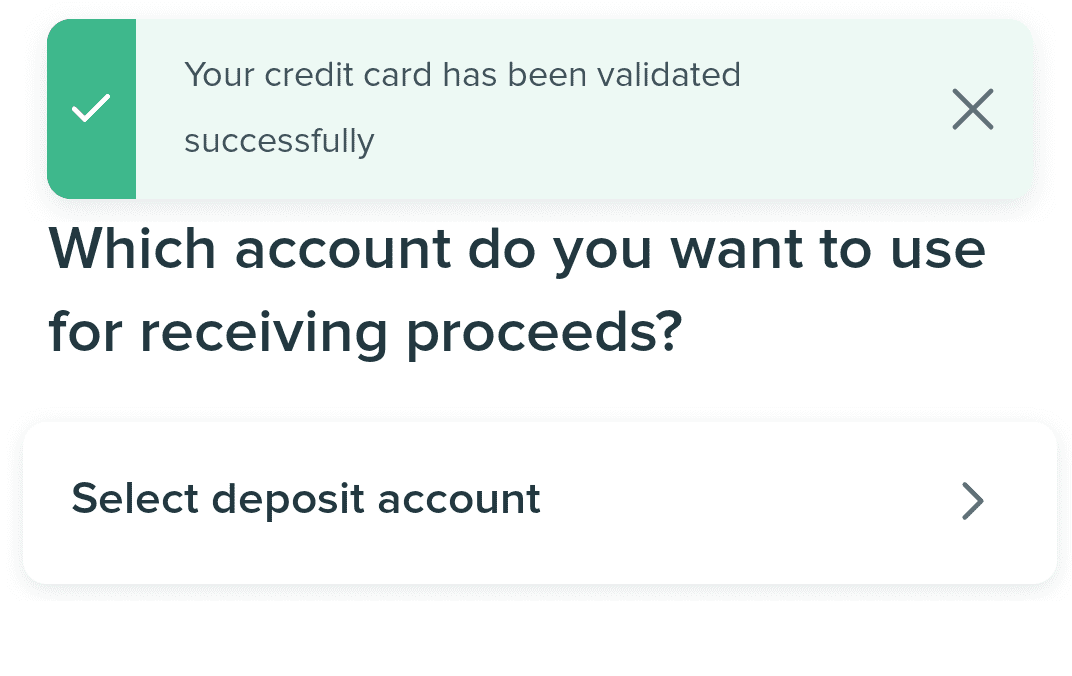

Step 3: Input your card’s expiry date to validate the account

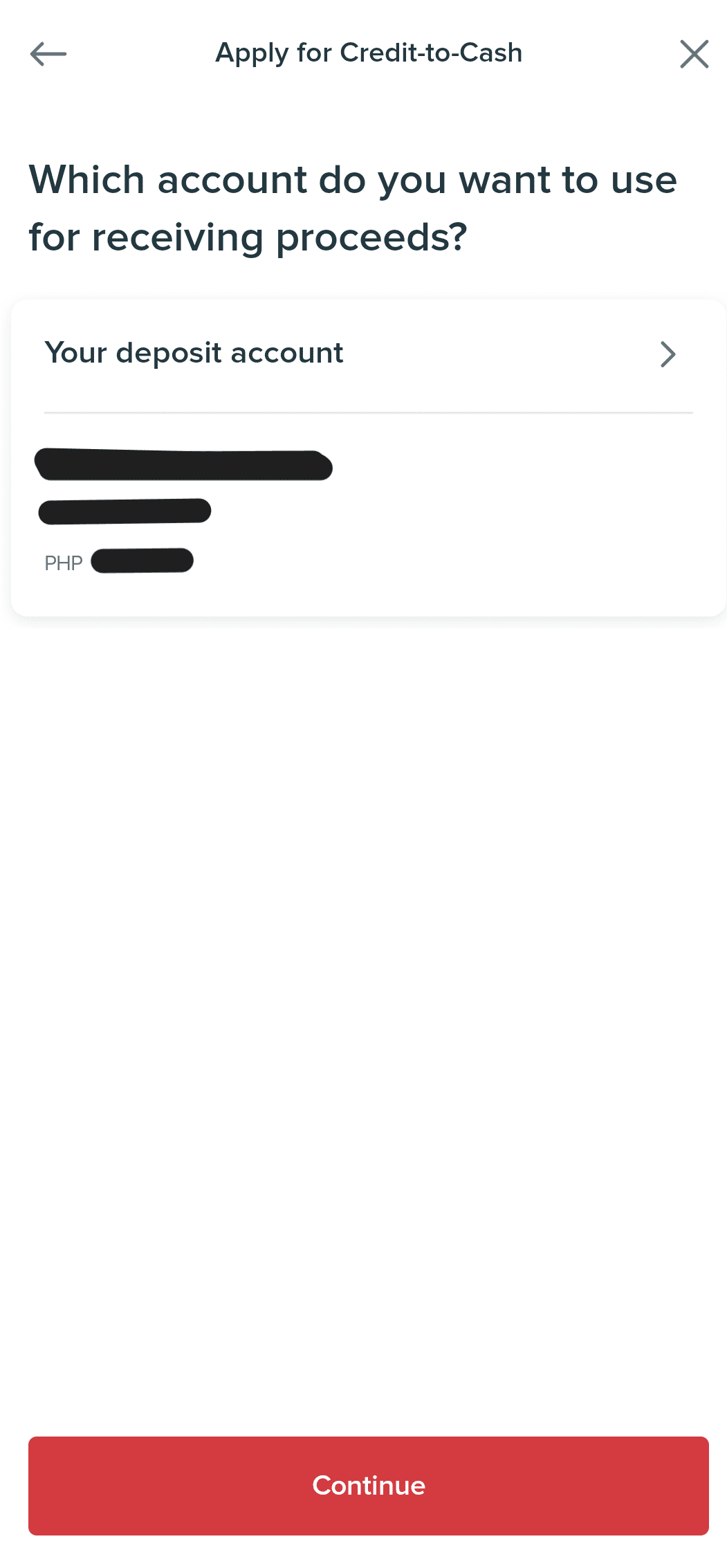

Step 4: Designate the deposit account

This is where the loan amount will be deposited.

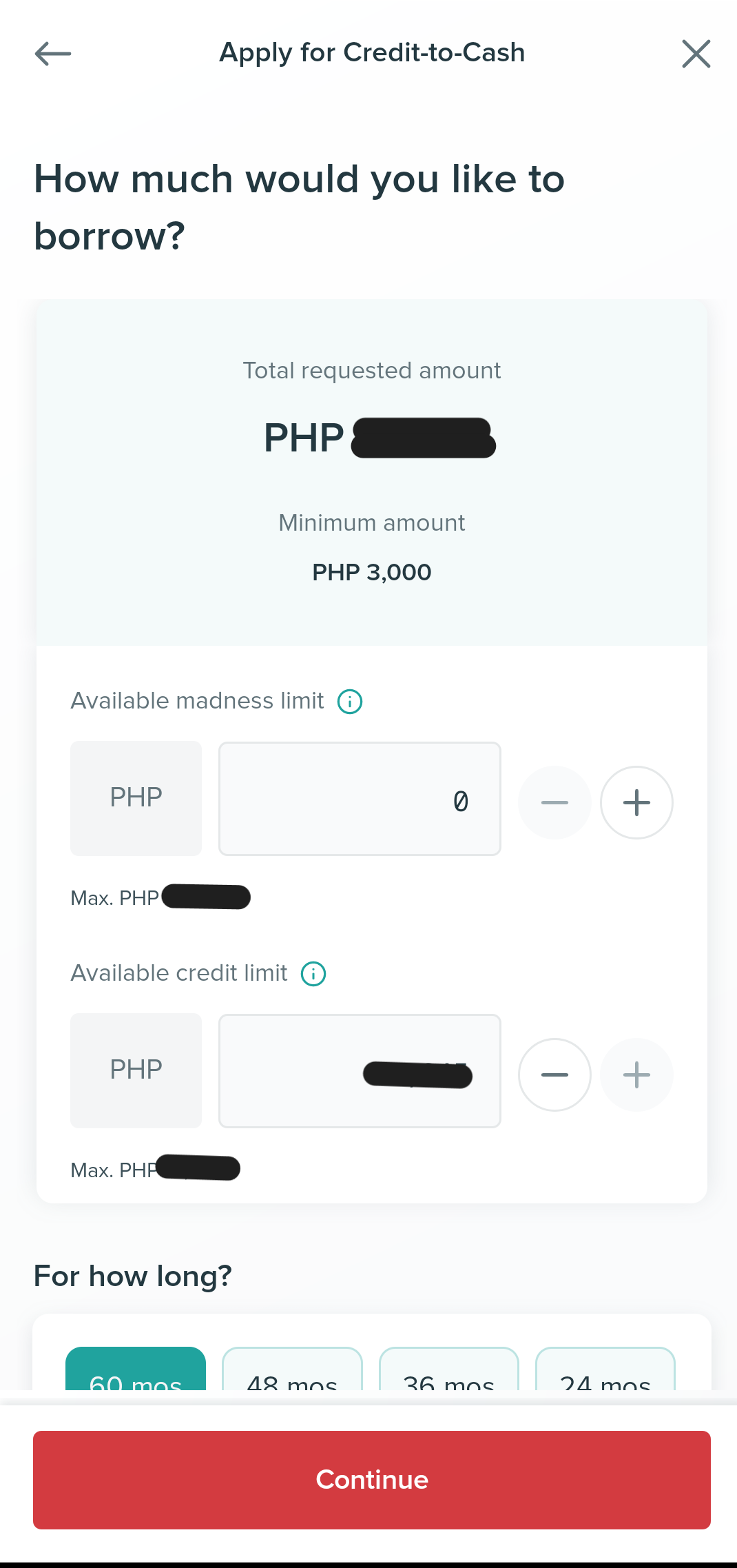

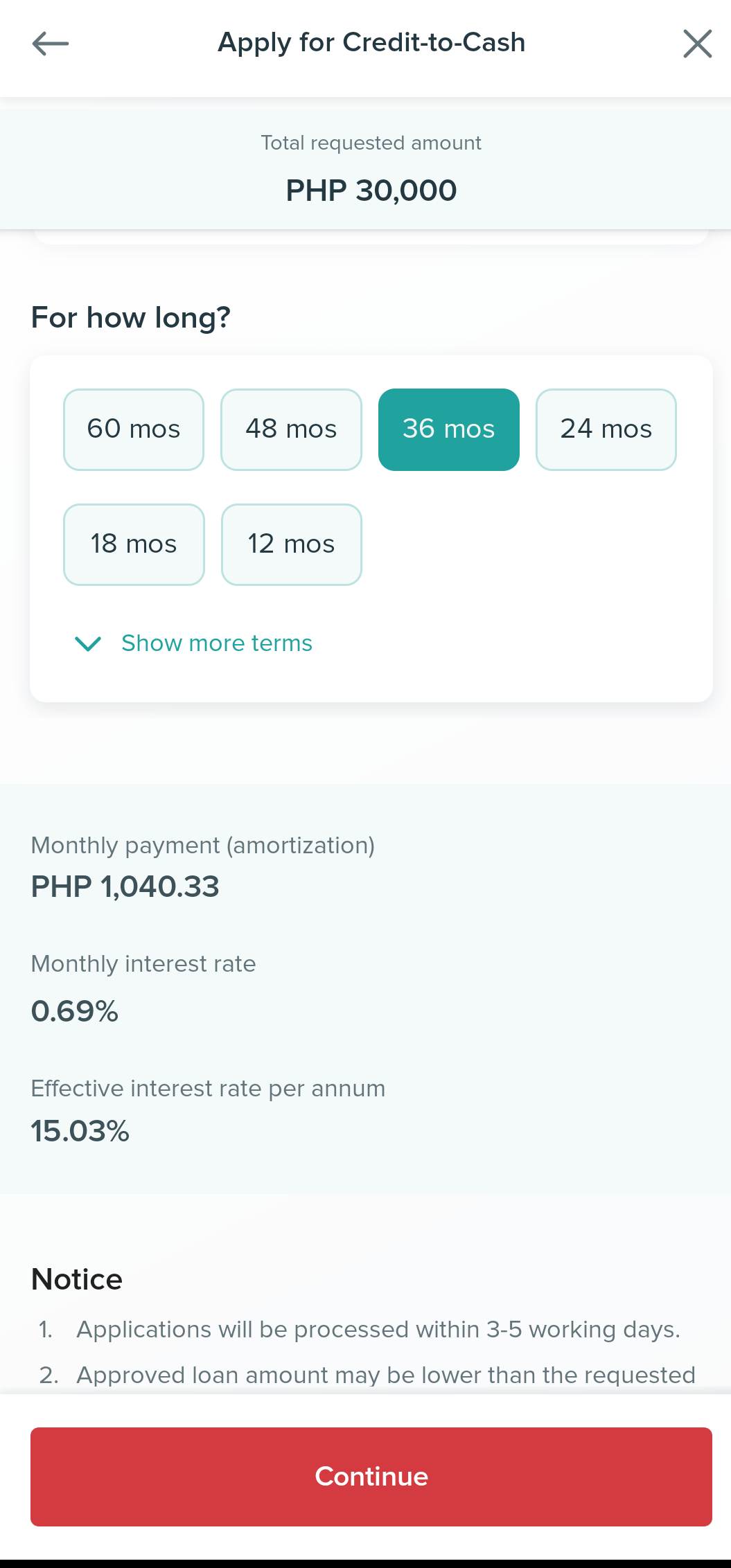

Step 5: Set the amount to borrow and payment terms

Note: by default, the credit limit amount is automatically populated by the available amount from your credit line. If you wish to use your madness limit, make sure to set the credit limit to 0.

The monthly interest rate varies between the terms. The lowest monthly interest rate is on the 36-month payment term.

Step 6: Agree to the BPI Credit’s Terms and Conditions

Once you put a check on the box and submit it, you’ll get a confirmation message regarding your application.

It will take 3-5 business days for the approval and crediting of the amount to your designated savings account.

Blogger’s Corner

I was dilly-dallying in posting this tutorial. However, I realized that there may be instances wherein a person may need such facilities for emergency reasons. I still recommend though ensuring that you have saved up enough emergency funds. That way, you won’t have to resort to applying for a loan.