With the Philippine SEC going after unregistered trading platforms that offer US stocks, some are left wondering what would be the next-best option.

How to buy US stocks via an SEC-registered company?

Well, you can always try Shari-Shari if you want to buy US stocks and ETFs since they’re registered under the SEC.

What other option do I have?

An alternative is investing via GCash’ GInvest > GFunds. They have a list of UITFS and Mutual Funds. Please note that they don’t manage those funds, they simply have tie-ups with those companies which allow them to list their products in GCash.

Some of the UITFs/Mutual Funds are similar to US ETFs.

ATRAM Global Technology Feeder Fund

Although not quite the same, the closest ETF equivalent I can think of is QQQ due to its exposure to some US tech stocks like Microsoft, Apple, and Alphabet.

That said it actually invests in Fidelity Global Technology Fund where it has exposure to stocks around the globe and not just concentrated in US tech stocks alone.

ALFM Global Multi-Asset Income Fund

This reminds me of SCHD since its focus is on dividend income. However, the target fund is Blackrock Global Multi-Asset Income Fund which I have discussed in a previous post.

ATRAM Global Health Care Feeder Fund

One would think of VHT with this one since their exposures are on Health care. Some of the top holdings for ATRAM Global Health Care Feeder Fund like UnitedHealth Group Inc, Eli Lilly & Co, and Thermo Fisher Scientific Inc are also in the top holdings of VHT.

That said, about 39% of its holdings are non-US companies.

What is the current performance of products listed in GFunds?

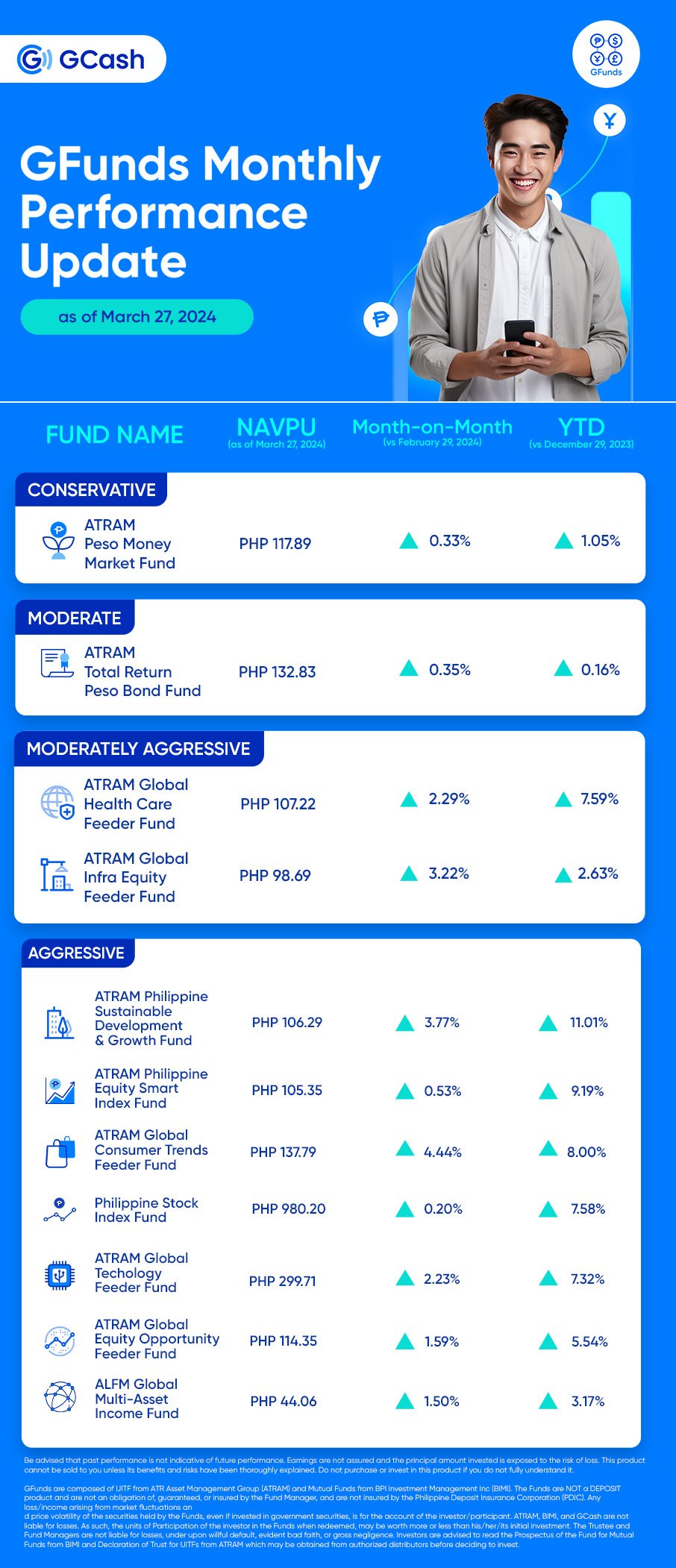

Here’s a screenshot of their performance as of March 2024:

Blogger’s Corner

I currently invest only in the ALFM Global Multi-Asset Income Fund but I used to put money in ATRAM Global Technology Feeder Fund. When I started investing directly in the US stock market, I pulled out from ATRAM.