Do you want to invest in SSS WISP Plus but don’t know how to do so? The steps are actually easy and can be done through the SSS online portal.

Brief Background about the SSS WISP Plus program

WISP Plus is a voluntary savings program offered by the Social Security System. This is equivalent to Pag-IBIG’s MP2 program wherein you’ll earn higher dividends compared to the provident WISP program. The maturity period is also similar to that of MP2 since you can withdraw your savings after 5 years. You can read more about the WISP Plus program in this article.

Steps on how to enroll in WISP Plus

Step 1

Log in to your SSS online portal account. If you don’t have one yet, If you don’t have an SSS online account yet, you can follow our step-by-step guide to create your account.

Step 2

Go to the Services menu and select Enroll to WISP Plus. You will then be shown the WISP Plus Enrollment screen.

Step 3

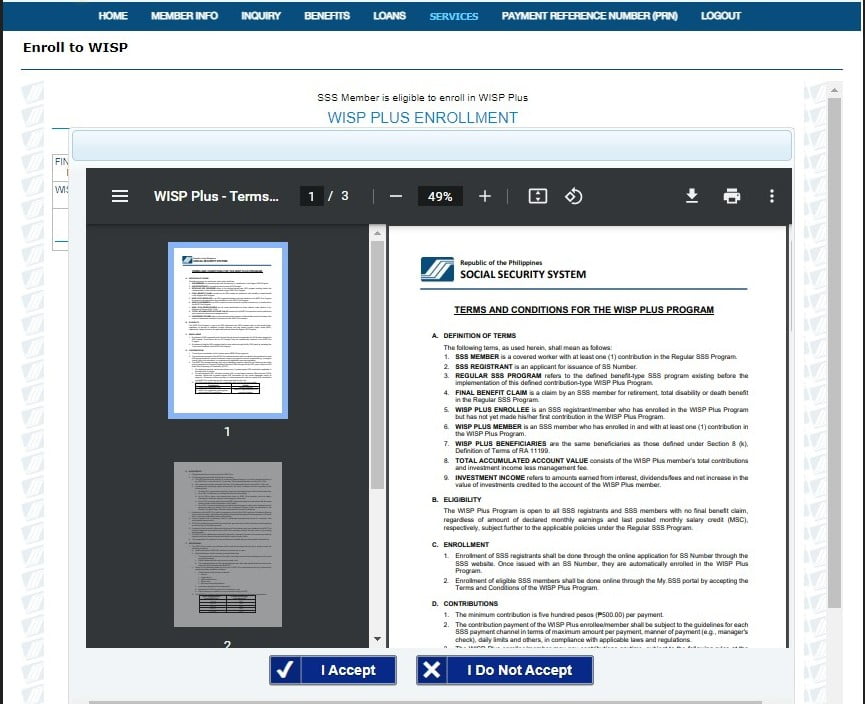

Select the VIEW TERMS AND CONDITIONS link. You will get a pop-up screen providing you with the terms and conditions for the WISP Plus program.

Select the I Accept button.

Step 4

You’ll get a new prompt informing you that you have successfully enrolled in the WISP Plus program. Just click on the Close button.

Step 5

And that’s it! You are now enrolled in the SSS WISP Plus program. The Enrollment page should reflect the enrollment date.

And if you head over to the Inquiry > Contributions page, this is what you’ll see:

Take note that the WISP Plus Enrollment and WISP Plus Membership are blank currently. Once you’ve made your first contribution, it will be populated accordingly. The WISP Plus Enrollment is the date when you created your WISP Plus account while the WISP Plus Membership will reflect the date when you first made your contribution.

Here’s a sample:

Blogger’s Note

I enrolled in the WISP Plus program back on February 25 but only made the initial contribution on September 8 since my initial plan was to focus only on MP2 when it comes to the investment/savings programs offered by the government. However, after evaluating my finances, I found a way to squeeze in WISP Plus in my portfolio.