The GStocks PH feature of GInvest in GCash has started to roll out to users. It’s not available for all but you can check your GCash app and see if it’s available for you.

Don’t get giddy just yet since you won’t be able to trade right away even if you can access the GStocks PH feature. You need to sign up first for a brokerage account and have to wait for the approval. Mine is not approved yet since I just signed up less than 2 days ago.

What I’m going to share though is what you need to do if the GStocks PH feature is available in the GInvest section of your GCash app.

Who is eligible for GStocks PH?

Anyone who meets the following requirements can sign up for GStocks PH:

- at least 18 years of age

- a Filipino citizen living in the Philippines

- a Fully Verified GCash user

- GCash information has been updated in the last 2 years

- has a valid government ID

How to determine if the Gstocks PH feature is available?

When you tap on the GInvest > GStocks PH and it gives you a message asking you to update your account information, then you’re in luck. That means that you can now enroll in a brokerage account. It’s possible though that those who created their GCash account within the last 2 years may not be asked to update their account information, but, as long as you don’t see the message saying that “We’ll let you know when this service becomes available”, then you’re good to go.

What are the steps to enroll?

- You need to Update your Account information first. You will go through the same verification process that you did when you created your GCash account.

- Once you get a confirmation SMS that your GCash profile is updated, go back to GInvest > GStocks PH. You will then see a “Get Started” button.

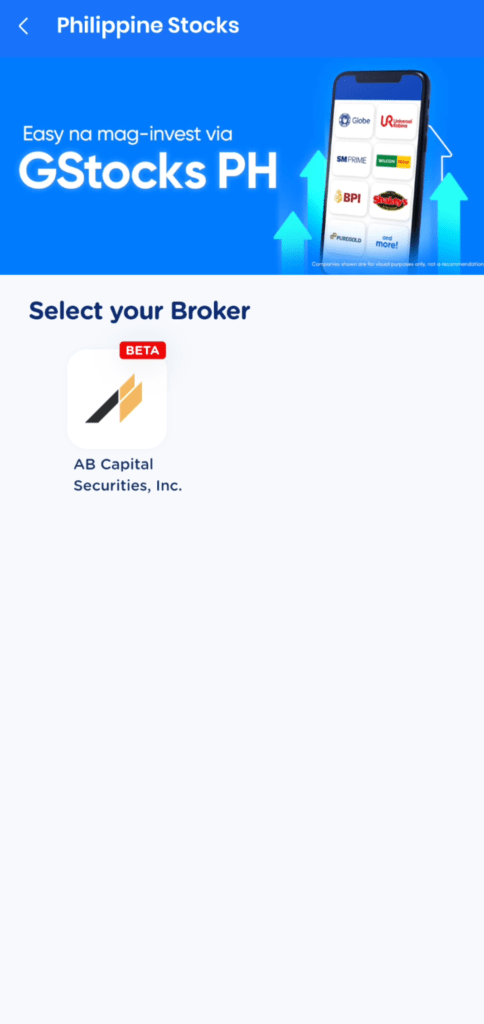

- You will be asked to select a broker. At the moment, there’s only one broker available which is AB Capital Securities, Inc. Once you tap on it, you will get a notification that you will be redirected to the registration page of the said broker. It’s a 5-step registration process.

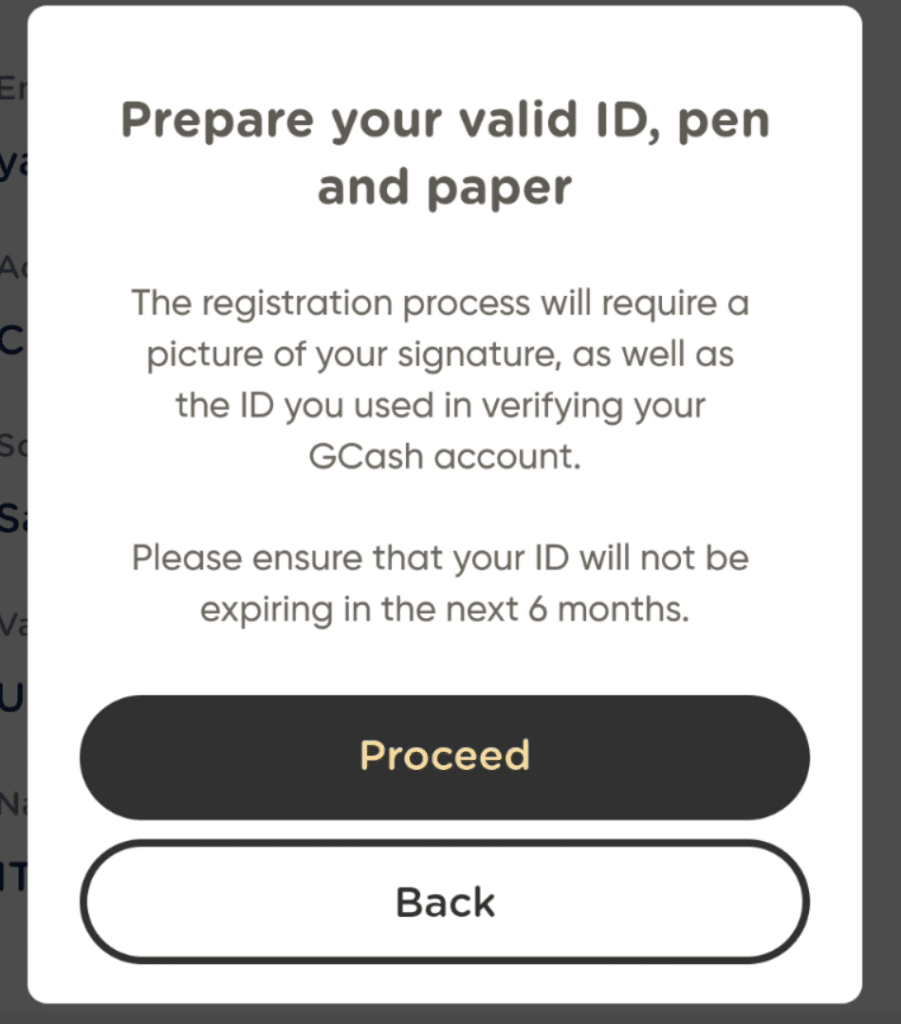

- Step 1 of 5 of the Broker registration is your personal information that was stored in GCash. So it’s already filled out for you. Once you click Next, you will be given a notification advising you to prepare your valid ID, pen and paper.

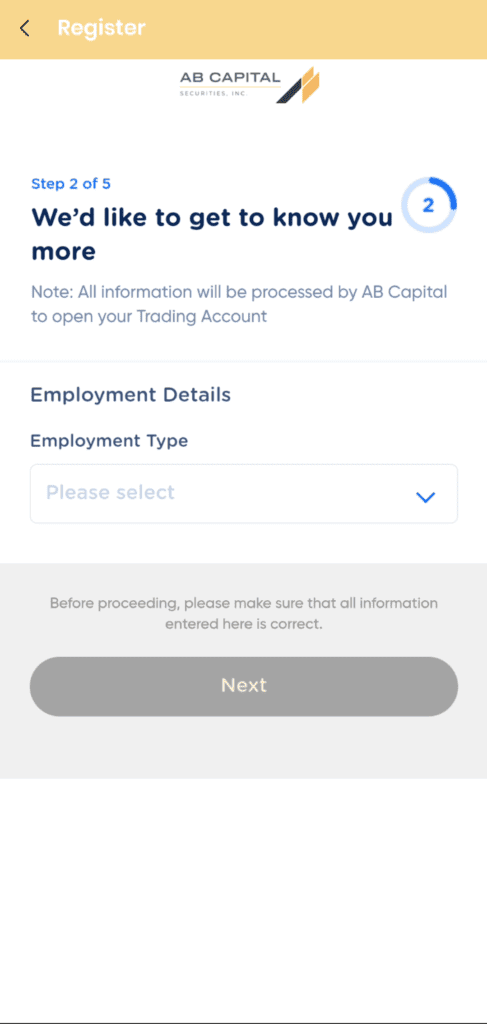

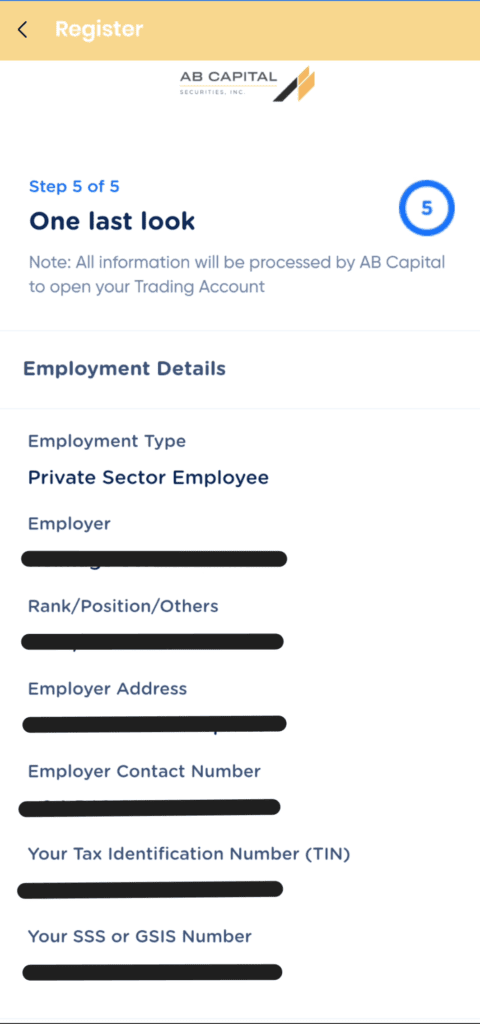

- Step 2 is all about your employment details. It will ask you for your TIN and SSS/GSIS number.

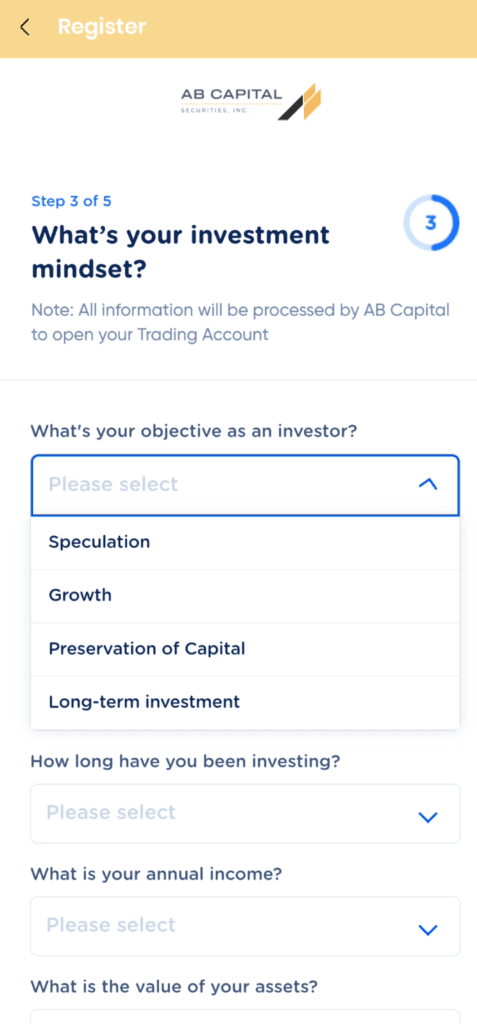

- For Step 3, you will be asked about your investment mindset.

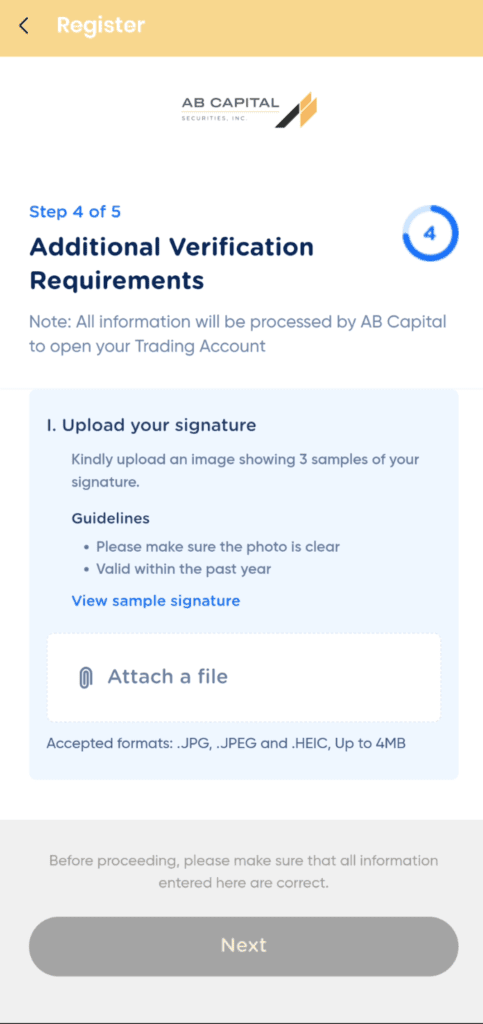

- In Step 4, you will be required to upload your signature. Ensure that you have taken a photo of your signatures (you need to write your signature 3 times on a piece of paper). The photo should be a max of 4MB file and it should be in a .jpg, .jpeg, or .heic format.

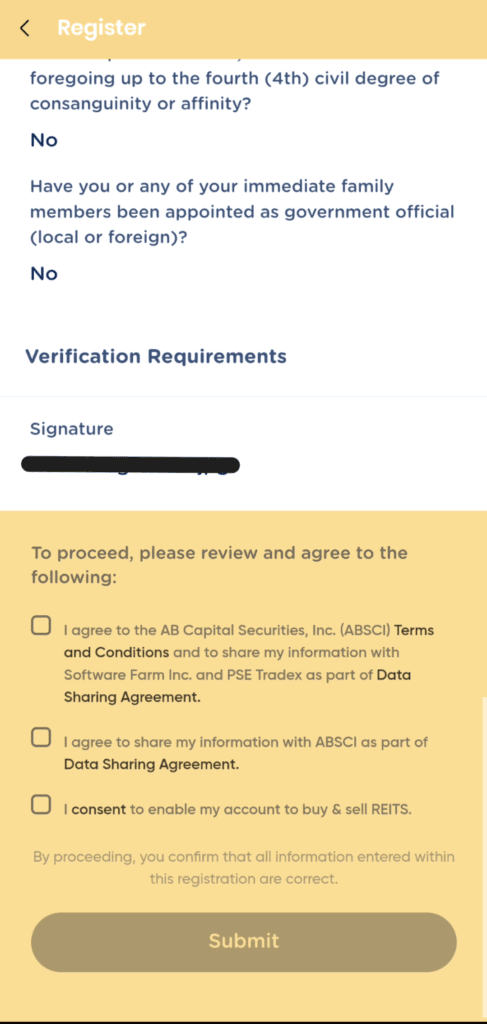

- Step 5 is simply a summary of what you have provided PLUS you will need to check the boxes to agree to the terms and conditions, data sharing agreement, and consent to enable your account to buy and sell REITs.

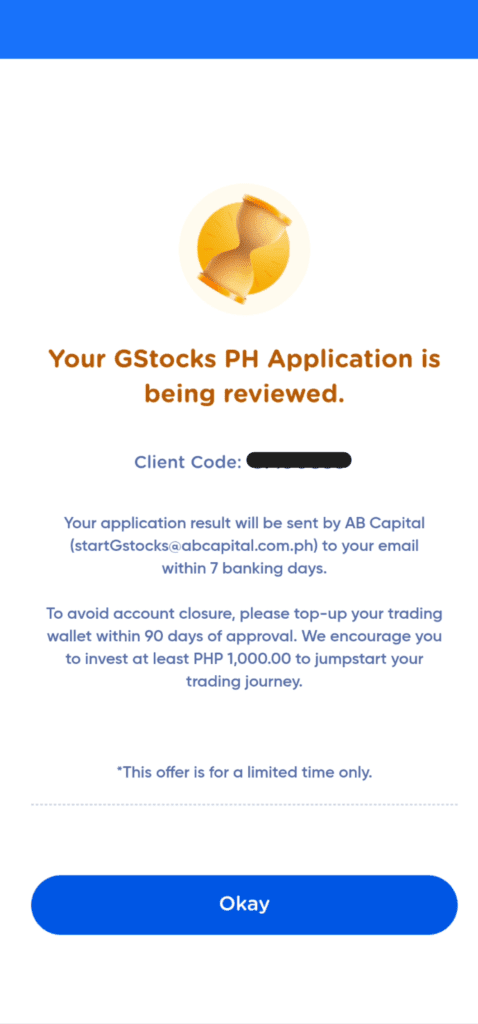

- Once done, you will get a message that your GStocks PH application is being reviewed and that an email will be sent to you within 7 banking days for the results of your application.

Here’s a slide show of the steps:

Blogger’s Note

I’ve been waiting for GCash to roll out the “stock-buying” options. Although I’m more excited about their Global Stocks than the PH stocks, this is really a piece of good news. With the rollout of GStocks PH, it’s much easier for Filipinos to get into stock investing. You don’t even have to sign up paper forms and go to a physical bank or send those forms via email.

Now how I wish that GCash is a publicly traded stock. I’ll probably divert some of my funds (that currently go to US stocks) to buy a GCash stock.

I’ll post a new blog post or perhaps create a tutorial article even once I get my brokerage account approved.