If you’re keeping your emergency fund or idle cash in MariBank, you may want to take note. The digital bank is set to lower its savings interest rates starting January 15, 2026, based on reports from users who received in-app notifications.

While the new rates are still higher than what traditional banks offer, this update continues the trend of digital banks slowly cutting interest rates as market conditions change.

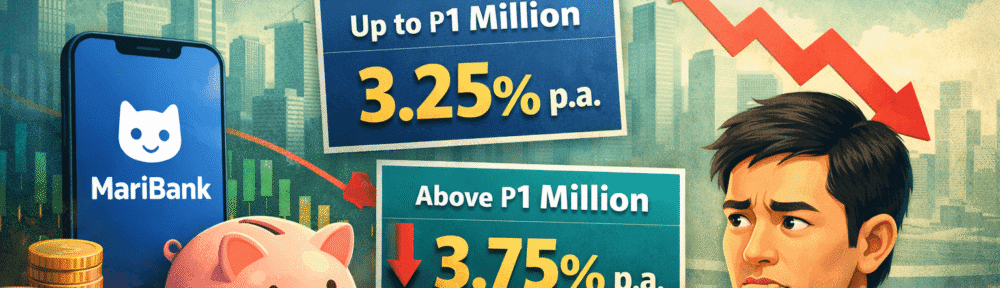

New MariBank Savings Interest Rates (Effective January 15, 2026)

Starting January 15, 2026, MariBank will apply the following interest rates to its savings account:

- Up to ₱1,000,000 balance: 3.25% per year

- Above ₱1,000,000 balance: 3.75% per year

Interest is still credited daily and remains subject to the standard 20% withholding tax.

This is a reduction from MariBank’s previous rates, where many users were earning around 3.5% to 4.0% per year, depending on their balance.

Why Is MariBank Cutting Its Interest Rate?

MariBank has not released a formal public announcement explaining the adjustment, but the reason is not surprising.

Digital banks typically lower savings rates when:

- Central banks begin easing or signaling lower policy rates

- Inflation stabilizes

- Competition for deposits becomes less aggressive

We’ve already seen similar moves from other digital banks in the Philippines over the past year. What we’re seeing now is not unique to MariBank, but part of a broader shift in the financial landscape.

Is MariBank Still Worth Using After the Rate Cut?

Even with the lower rates, MariBank still offers advantages:

- Higher interest than most traditional banks

- Daily interest crediting

- Fully digital access and convenience

However, if your primary goal is maximizing interest, this update means it may be time to re-evaluate where you park your savings. Some digital banks still offer higher promo rates, time deposits, or goal-based savings products that may outperform standard savings accounts.

A common strategy is to spread funds across multiple banks, keeping liquidity in one account while chasing higher yields elsewhere.

Sample Interest Computation

Here’s a simple illustration of how the new rates compare:

- ₱100,000 at 3.25% earns around ₱3,250 per year (before tax)

- ₱500,000 at 3.25% earns around ₱16,250 per year (before tax)

- ₱1,000,000 at 3.25% earns around ₱32,500 per year (before tax)

Actual earnings may vary slightly due to daily compounding.

Blogger’s Corner

High interest rates from digital banks were never meant to last forever. They were tools to attract users and grow deposits quickly.

Now that digital banks are more established, we’re seeing rates normalize. This is why relying on a single savings account for long-term wealth growth is risky. Savings accounts are best for liquidity and safety, not for beating inflation long term.

If you’re serious about growing your money, savings accounts should only be one part of your overall strategy.