I’m sure some of you are already itching for me to start discussing investment-related topics on this personal finance blog. I am too. In fact, I am more than excited to share with you my journey in the stock market.

That said, we must lay the groundwork first and not rush things out.

It’s important for you to evaluate your financial situation first. Take a look at your current financial state, including your debts, income, and expenses, to determine how much you can afford to invest.

If you haven’t noticed, I started off with topics regarding emergency funds and high-yield savings accounts. Pero di pa tayo tapos sa “boring” and (for some people) “mabigat” na discussions. So alam nyo na? This means, na ang next topic na ihahighlight muna natin is all about debts.

Once we’re done with all that, we’ll start treading on the juicier topics.

What to expect on future posts

Here are some of the topics that we’ll cover soon:

- Pag-IBIG MP2

- Philippine Stock Market

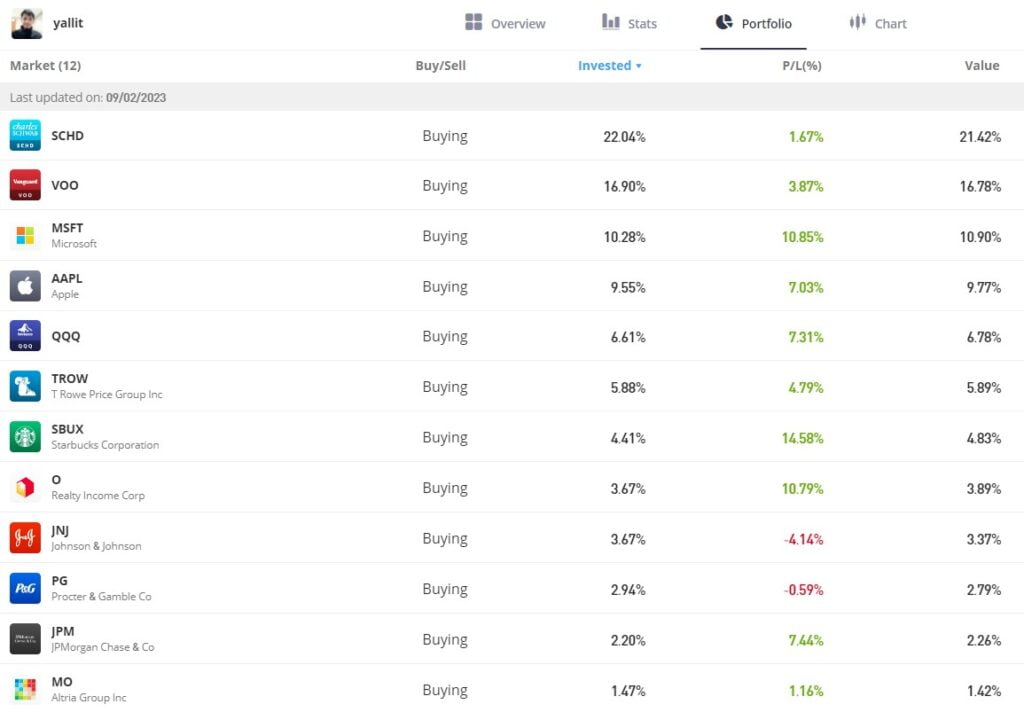

- US Stock Market

- Mutual Funds

- Insurance

At marami pang iba. Take note this is a Personal Finance blog. Di tayo mauubusan ng pag-uusapan dito.

As for the first 3 that I mentioned, you can click the associated links for those since I have already prepared articles related to those topics. Similarly, you can go to the Investment and Finance menu to see those articles.