When investing in Pag-IBIG MP2, one of the key decisions you need to make is how to receive your dividends. MP2 offers two options: annual dividend payout or compounding until the 5-year maturity. Which is better for your goals? Let’s break it down.

What Is Annual Dividend Payout?

The annual dividend payout option means that every year, Pag-IBIG will credit your dividends to your bank account or issue a check (Note: you still have to file a claim). These dividends come from Pag-IBIG Fund’s net income, which is declared every year.

- Tax-free: MP2 dividends are fully exempt from withholding tax.

- Frequency: Credited yearly, instead of waiting for the 5-year term.

- Flexibility: You can spend or reinvest the dividends as you like.

For example, if you contribute ₱500,000 upfront and the dividend rate is 7.1% (2024 rate), you’ll get around ₱35,500 per year in dividends.

When Annual Payout Makes Sense

Choosing annual payout is ideal if you:

- Want regular income

- Annual payout gives you cash every year to supplement your budget or emergency fund.

- Need liquidity

- Unlike compounding, you can access your dividends immediately without waiting 5 years.

- Plan to reinvest dividends elsewhere

- You could invest the yearly dividend in stocks, mutual funds, or business opportunities.

- Prefer predictable cash flow

- Annual payouts make it easier to plan for yearly expenses without touching your main contributions.

The Trade-Off: Less Growth for Long-Term Goals

If your main goal is long-term wealth building, annual dividend payout is generally not optimal.

- No compounding effect: Dividends are taken out each year instead of being reinvested automatically in MP2.

- Lower total return: Over 5 years, compounded dividends grow faster than payouts taken annually.

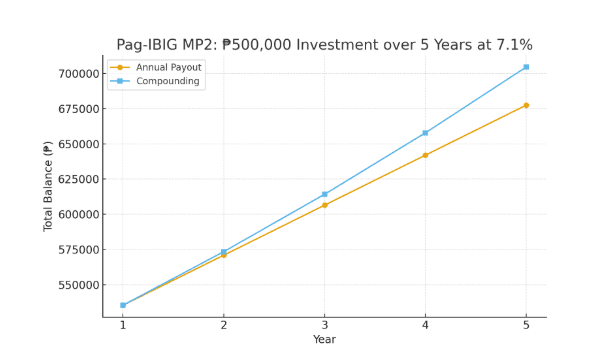

Example Comparison Using ₱500,000 and 7.1% Dividend Rate

| Option | Contributions (₱) | Dividends (₱) | Total at End of 5 Years (₱) |

|---|---|---|---|

| Annual payout | 500,000 | ~35,500 per year × 5 = 177,500 | 677,500 |

| Compounding | 500,000 | ~7.1% compounded yearly | ~706,000+ |

Numbers assume a 7.1% dividend rate per year. Compounding adds more because dividends themselves earn dividends each year.

Here’s the visual chart comparing ₱500,000 MP2 investment over 5 years at 7.1% dividend rate:

- Annual Payout: Dividends are taken out yearly and do not compound.

- Compounding: Dividends are reinvested, so the balance grows faster over 5 years.

✅ Key takeaway: If you don’t reinvest the annual payouts elsewhere, your money grows slower than it would with compounding.

Conclusion: When to Choose Annual Payout

- Annual dividend payout is best for: cash flow, yearly income, reinvesting in higher-yield opportunities, or if you value liquidity.

- Compounding is best for: long-term growth inside MP2 without touching the money for 5 years.

So, before opening your MP2 account, ask yourself: Do I want steady yearly cash, or do I want my savings to grow as much as possible? Your answer will guide your choice.

Blogger’s Corner

Pag-IBIG MP2 is a low-risk, high-return savings program for Filipinos. Picking the right dividend option can make a significant difference in your savings journey. Personally, for long-term goals like building wealth or funding a major expense, I lean toward compounding, but if you’re managing yearly cash flow, annual payout is perfectly reasonable.