Here’s another bank that offers a high-yield savings account that you might want to consider. And you can easily set up an account via GCash.

What is UNO Digital Bank?

They are a digital bank that offers a high-interest savings account with tiered interest rates.

What is the interest rate?

The base interest rate is 3.5%, which could get to as high as 4.25% depending on your available balance at the end of the day.

| From | To | Gross Interest Rate per Annum |

| Php 0.01 | Php 4,999.99 | 3.5% |

| Php 5,000 | Php 4,999,999.99 | 4.25% |

| Php 5M | Above Php 5M | 1% |

How are interests credited?

Interests are credited daily using the following computation:

Gross interests earned = Principal * Interest rate * (1/number of days in the year)

Please take note that interest earned is subject to a 20% tax (like any other bank).

How to create a UNO account

There are 2 ways to create your UNO account. The first option is to download the UNO app and create your account from there. The other option is via GCash which will be steps that will be provided here.

Note: If you create your account via the UNO app first, you won’t be able to link it to GCash.

Step 1: Go to GSave from your GCash homepage

You will see the available partner banks. Tap on UNO Digital bank.

Step 2: Tap on Apply Now on the next 2 screens

Step 3: Check the mandatory consent boxes to continue

The 4th box is optional.

Step 4: Fill out your details

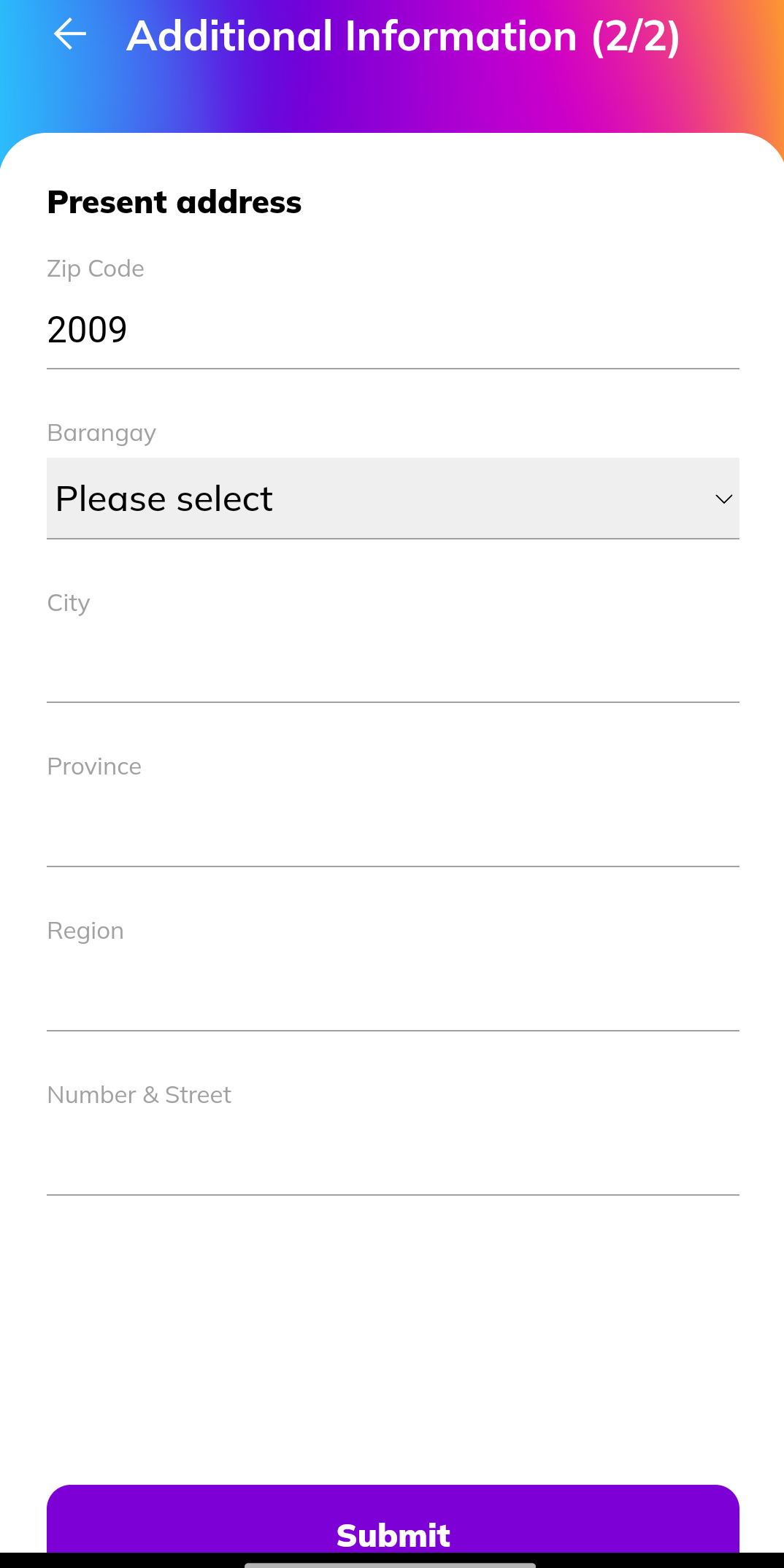

The next 2 screens will ask for the following:

- Gender

- Place of Birth

- Employment Type

- Purpose for opening an account

- Certification of US/Non-Us status

- Present Address

Once you are done with filling out your details, just hit Submit.

Step 5: Confirmation

After performing Step 4, you’ll see a processing message and then a congratulations screen.

And here’s what the dashboard looks like:

Blogger’s Corner

You can install the stand-alone app of UNO Digital Bank and link the one you created via GCash. Make sure to deposit an amount to your UNO account to activate it first. Else it won’t detect a GSave-created UNO account. I’ll create a separate post for the steps.