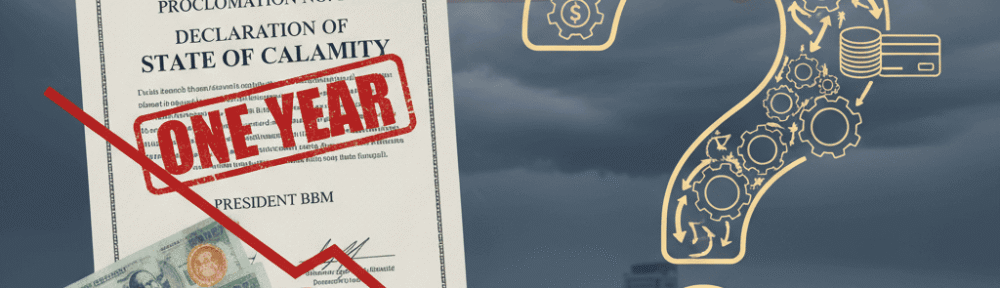

President Ferdinand “Bongbong” Marcos Jr. (BBM) has declared a one-year nationwide State of Calamity through Proclamation No. 1077, following the massive destruction caused by Typhoon Tino across the Visayas and parts of Luzon and Mindanao.

While this move allows government agencies to respond faster, it also carries major financial implications for ordinary Filipinos — especially for those planning to file Pag-IBIG or SSS calamity loans, or those struggling with rising prices.

What the One-Year State of Calamity Means

A State of Calamity allows the government to:

- Release quick-response funds for relief and rehabilitation.

- Impose price freezes on basic goods.

- Grant no-interest or low-interest loans to affected individuals.

- Expedite insurance, tax, and aid-related claims.

But this time, the declaration lasts for an entire year, giving agencies like DSWD, SSS, and Pag-IBIG more time to support affected communities — and giving you more time to apply for financial assistance.

1. Pag-IBIG Calamity Loan Remains Available

If you’re a Pag-IBIG member in an area declared under the State of Calamity, you may qualify for the Pag-IBIG Calamity Loan.

You can borrow up to 80% of your total savings in the fund, with a 5.95% annual interest rate — one of the lowest in the market.

The good news: the one-year duration means that the calamity loan window will stay open longer for declared areas, giving members more time to process their applications.

Related guide:

How to File a Pag-IBIG Calamity Loan

2. SSS Calamity Loan for Affected Workers

For SSS members, a State of Calamity declaration automatically activates the SSS Calamity Loan Assistance Program (CLAP).

You can borrow up to ₱20,000 depending on your contribution record, payable in two years with a 10% interest rate per annum.

If you’re employed in an area affected by Typhoon Tino, your employer can also help facilitate the loan application via the My.SSS portal.

Related guide:

How to File an SSS Calamity Loan

3. Price Control and Inflation Impact

Under a State of Calamity, the Department of Trade and Industry (DTI) enforces a price freeze on essential goods like rice, canned food, bottled water, and fuel.

However, despite these controls, supply chain disruptions could still cause minor price spikes — especially in non-essential items and construction materials used for rebuilding.

If you live in affected provinces, expect some price volatility but don’t panic buy — hoarding can lead to artificial shortages.

4. Time to Reassess Your Emergency Fund

A one-year State of Calamity isn’t just about government action — it’s also a wake-up call for personal finance.

If your savings can’t cover at least 3 to 6 months of expenses, this is the time to start building your emergency fund.

Natural disasters are becoming more frequent, and financial readiness is now part of survival.

If you want a guide, check out my article on Emergency Funds: What They Are and How to Build One.

5. Keep Your Documents Ready

Government agencies usually require proof that your area is under a declared State of Calamity — such as a barangay certification or local declaration notice.

Keep these documents ready when applying for assistance or loans to avoid delays.

Blogger’s Corner

This one-year declaration gives us more time — but it also reminds us that financial preparedness is a lifelong responsibility.

Don’t wait for the next typhoon to hit before securing your emergency fund, insuring your property, or building passive income streams.

If you’re eligible, take advantage of government relief programs like Pag-IBIG and SSS loans. These aren’t handouts — they’re your contributions working for you during hard times.