Your credit score is one of the most important numbers you’ll ever have — yet most Filipinos don’t even know it exists. Whether you’re planning to get a loan, apply for a credit card, or even rent a property, your … Continue reading

Category Archives: Investment and Finance

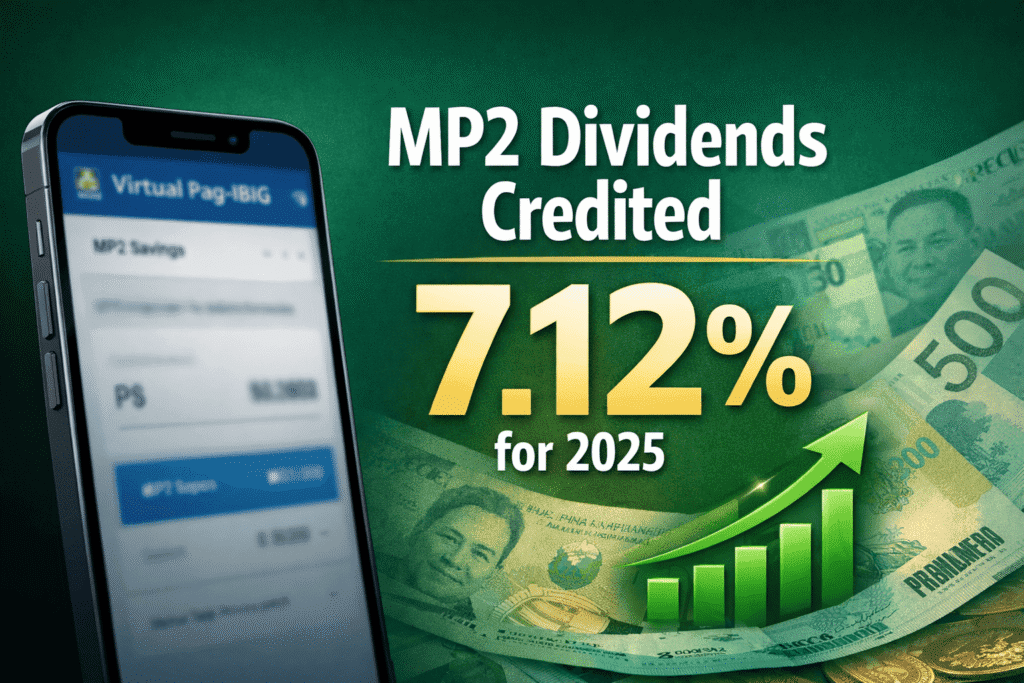

2025 Pag-IBIG MP2 Dividends Credited: How to Check Your Earnings Now

Good news for Pag-IBIG MP2 savers — the 2025 dividends have been officially declared and are now in the process of being credited to member accounts. Many members have started seeing their 7.12% dividend earnings reflected in Virtual Pag-IBIG, while … Continue reading

How to Check Your Home Development Mutual Fund (Philippines) Dividends Online (Step-by-Step Guide)

If you are a member of the Home Development Mutual Fund (Philippines) (Pag-IBIG Fund), it is important to monitor how your savings are growing over time. You can check your dividend records online through: What Are Pag-IBIG Dividends? Pag-IBIG dividends … Continue reading

Topping Pag-IBIG Regular Savings: Is Voluntary Top-Up Worth It?

For many members of the Home Development Mutual Fund (Pag-IBIG Fund), regular contribution is already part of monthly payroll deduction. But some members choose to add voluntary savings by topping up their regular contribution. The question is simple: 👉 Is … Continue reading

Pag-IBIG Dividend Rates for 2025 (Official) — Record Returns for Members!

Pag-IBIG Fund has officially announced the dividend rates for 2025 — and once again, members are getting strong, tax-free returns. If you’re contributing to Pag-IBIG Regular Savings or investing in MP2, here are the confirmed numbers you need to know. … Continue reading

How to Earn Cashback with ShopBack Philippines (2026 Updated Guide)

ShopBack continues to be one of the easiest ways to earn cashback while shopping online. You can now earn cashback not only from traditional shopping but also from games and other activities in the ShopBack app. Cashback rates, cashback crediting … Continue reading

Where to Park Your Emergency Fund in 2026: Safe & Smart Options

IntroductionHaving an emergency fund isn’t optional—it’s a financial lifesaver. Whether it’s medical bills, sudden job loss, or urgent home repairs, your emergency fund gives you peace of mind. But in 2026, where should you park your cash to keep it … Continue reading

How to Create a Pag-IBIG MP2 Account Online (Step-by-Step Guide)

Opening a Pag-IBIG MP2 account is still one of the easiest ways for Filipinos to start investing in a government-backed savings program. The enrollment process remains fully online through the official Pag-IBIG Fund MP2 portal, and you can complete it … Continue reading

Pag-IBIG Virtual Account Locked? Here’s How to Recover It

If you’ve tried logging in to your Virtual Pag-IBIG account recently and got locked out, you’re not alone. This happens to many members due to multiple failed login attempts, inactivity, or security measures. The good news is that recovering your … Continue reading

Why Most Financial Advice on TikTok Is Dangerous

TikTok has become one of the most popular places where Filipinos get financial advice. A 30-second video tells you how to grow ₱10,000 into ₱1 million, escape the rat race, or earn passive income while you sleep. The problem is … Continue reading