Investors can use many types of stock investment strategies to grow their wealth. There are investors who prefer to earn by scalping or day trading to get immediate income and then there are those who prefer to buy and hold instead.

I am more of a long-term investor so I focus mainly on the following strategies:

- Dividend Investing

- Growth Investing

- Index Investing

Let’s take a closer look at these strategies, shall we?

Dividend Investing

Dividend investing involves buying stocks that pay regular dividends to shareholders. Dividends are payments made by companies to their shareholders, typically as a portion of their profits. For example, if you own 10,000 worth of a stock that pays a 4% dividend yield, you would receive 400 in annual income. To make the concept easier to understand, this is somewhat similar to getting a 4% interest from a high-yield savings account.

Companies that pay dividends tend to be established, financially stable, and have a history of consistent earnings. Hence, dividend investing is a good strategy for investors looking for a steady source of income, as well as the potential for long-term growth.

In addition, dividend-paying stocks tend to be less volatile than growth stocks, making them a good option for investors who want to mitigate risk. So yung mga mahilig sa kape, this one’s for you.

Examples of Dividend Stocks

Johnson & Johnson (JNJ)

JNJ is a healthcare company that has paid dividends for over 50 consecutive years and has a current dividend yield of around 2.5%.

Coca-Cola Company (KO)

As we all know, Coca-Cola is a beverage giant that operates in over 200 countries. The company has a strong brand and has been paying dividends for over 100 years. KO’s current dividend yield is around 3.2%.

Growth Investing

On the other hand, growth investing involves buying stocks in companies that have the potential for significant growth in the future. Growth stocks are typically companies that are in their early stages of development, with innovative products or services that have the potential to disrupt the market. This is why most growth stocks are from companies in the IT industry.

Growth investing can be a good strategy for investors who are willing to take on more risk in exchange for the possibility of a higher return.

Examples of Growth Stocks

Amazon.com Inc. (AMZN)

Amazon is a technology and retail giant that has been experiencing rapid growth over the past decade. The company’s revenue and earnings have been consistently increasing due to its dominance in the e-commerce and cloud computing industries.

In 2017, Amazon was trading at around $58, it reached a peak of 186.12 on July 8, 2021. So that was a 320% increase between 2017 and the peak price. And though it’s currently trading at $90 per share, it’s still 155% higher than its share price back in 2017.

Tesla Inc. (TSLA)

Tesla is an electric vehicle and renewable energy company that has been growing at a rapid pace. The company has been disrupting the automotive industry and has plans to expand into other markets like energy storage and solar power.

Index Investing

Index investing involves buying a portfolio of stocks that tracks a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Index investing can be a good strategy for investors who want to take a more passive approach. Think of it as a basket full of eggs wherein the basket is the Index and the eggs are the stocks. So instead of you having to research and nitpick on what stocks to buy, you can just simply buy an ETF or an Index fund and you’ll already be diversified.

Examples of Index Funds

Invesco QQQ Trust (QQQ)

This ETF tracks the performance of the Nasdaq-100 Index, which includes 100 of the largest non-financial companies listed on the Nasdaq stock exchange. This index fund provides investors with exposure to technology and growth-oriented companies.

Vanguard S&P 500 ETF (VOO)

This ETF tracks the performance of the S&P 500 Index, which includes 500 large-cap US stocks across various sectors. This index fund is issued by Vanguard and has a low expense ratio, making it an attractive option for investors looking to gain exposure to the broad US stock market with lower costs.

My Portfolio

Since my strategy is a mixture of those three, all of the stocks and ETFs that I’m currently buying provide dividends. This means that I don’t own any Tesla or Amazon shares because they don’t give out dividends. Rather, for growth stocks, I opted for Apple and Microsoft. That said, one of the ETFs I’m currently buying gives me exposure to non-dividend growth stocks as well.

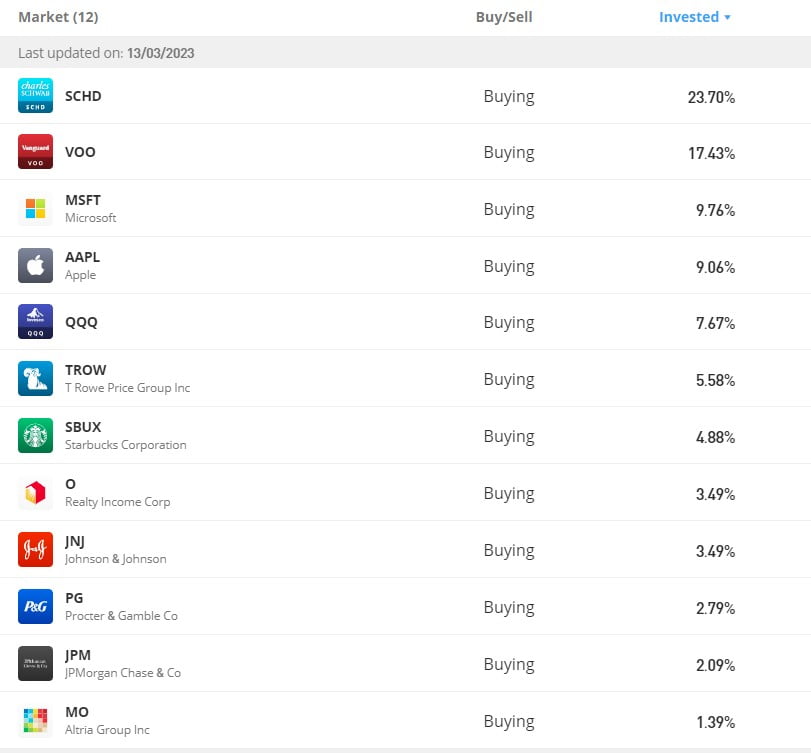

Here’s my actual portfolio in eToro:

From the list, Apple, Microsoft, and Starbucks are considered growth stocks. And since QQQ tracks the Nasdaq-100 Index, it’s leaning toward growth stocks as well. So if you do the math, around 30% of my portfolio is growth investing. And if you look closely, 3 of those listed are ETFs which totals roughly 48%. But then all of them provide dividends.

You might be wondering why I have this mixed portfolio. Here are my reasons:

- I am a long-term dividend investor, hence the entirety of the portfolio focuses on stocks and ETFs that offer dividends.

- However, I don’t want to miss out on the potential high returns of the growth stocks as well.