Paying your Pag-IBIG MP2 contributions on time is super important if you want to maximize your savings and earn those dividends. Good news: you don’t have to line up at a branch anymore! With digital wallets like GCash, you can pay anytime, anywhere, whether it’s a monthly contribution or a lump sum.

In this guide, I’ll show you step-by-step how to pay MP2 using GCash, plus common issues people run into and tips to avoid them. This way, you won’t have to worry about missed payments or delayed processing.

Why Use GCash to Pay MP2

There are a few reasons why GCash is one of the easiest ways to pay your MP2 contributions:

- Convenience: Pay directly from your phone—no need to visit a branch or ATM.

- Anytime, anywhere: You can make payments at 2 AM if you want, seriously.

- Supports any payment type: Lump sum or monthly contributions, both work smoothly.

- Easy record keeping: You’ll get a confirmation receipt instantly, which you can save or screenshot.

If you’re new to MP2, this is especially helpful because you can track your contributions without stress. You can also link this to your eGovPH account to check your balance anytime.

Step-by-Step Guide to Pay MP2 Using GCash

Here’s how you can pay MP2 savings through the GCash app:

Step 1: Open GCash App

Log in to your GCash account. Make sure you have enough balance to cover your MP2 contribution and the ₱5 service fee.

Step 2: Go to “Bills”

From the GCash dashboard, tap Bills.

Step 3: Select “Government”

Scroll down and choose Government from the categories.

Step 4: Select “Pag-IBIG”

Under government billers, tap Pag-IBIG Fund, then tap Pag-IBIG.

Step 5: Fill Out Payment Details

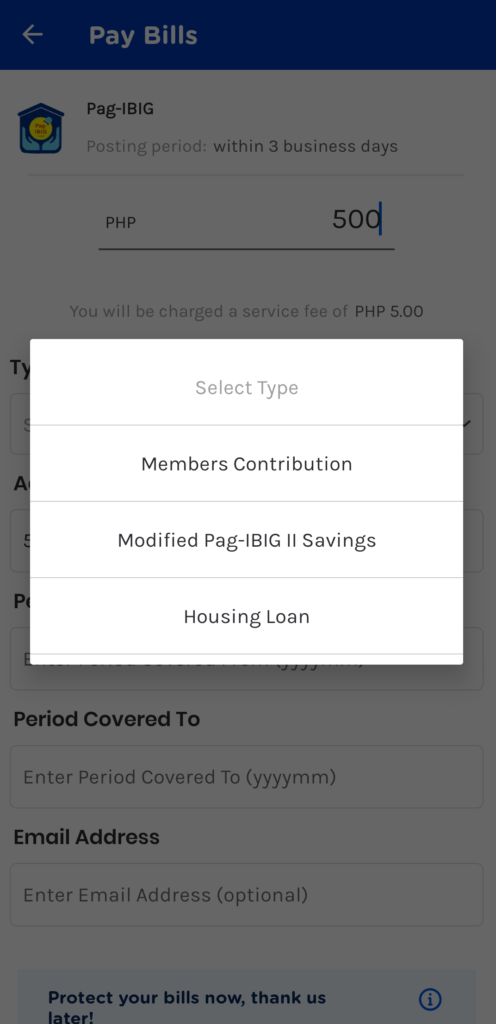

This is where many get confused. Fill out the fields carefully:

- Amount: Your desired contribution (minimum ₱500)

- Type: Modified Pag-IBIG II (MP2)

- Account No (12-20 digits): Your 12-digit MP2 account number (starts with 5)

- Period Covered: For monthly payments, you can indicate the current month (e.g., 08/2025 for August 2025).

- Email Address: Optional, but good if you want a payment confirmation.

Step 6: Confirm and Pay

Review all the details. Once sure, tap Confirm and proceed with payment.

Step 7: Get Payment Confirmation

GCash will show a receipt and send you an SMS confirmation. Keep this as proof of payment.

Common Problems & Troubleshooting

Even if GCash makes it easy, a few things can go wrong. Don’t panic—here’s how to handle the most common problems:

- Payment not reflecting after 1–2 days

- Solution: Check your MID number and ensure you saved the confirmation. Sometimes payments take 1–2 business days to appear.

- Account number error

- Solution: Double-check your Pag-IBIG MID. A single typo can block the payment.

- GCash doesn’t show Pag-IBIG under Bills

- Solution: This happens sometimes due to temporary app updates. Try logging out and back in, or use search within Bills.

- Split payments / multiple entries

- Solution: Make sure you enter the correct month or period covered for each payment to avoid creating duplicates.

Tips for Smooth Payments

Here are a few pro tips to make sure your GCash MP2 payments go without a hitch:

- Always double-check your MID before confirming.

- Use official apps only—never pay through unofficial or third-party platforms.

- Try to pay a few days before the month-end cutoff to avoid delays.

- Keep a record of all receipts—screenshot the confirmation or save the PDF.

- If you pay lump sum, double-check the total amount to avoid short payments.

These little habits save you from headaches later.

Important Reminders When Paying MP2 via GCash

- Service Fee: Each MP2 payment through GCash has a ₱5 convenience fee.

- Processing Time: Payment reflects in Pag-IBIG’s system within 2–3 business days.

- Double Check Your Account Number: Mistyped account numbers are a common mistake. Always confirm before paying.

- For Lump Sum Investors: If you want to put in a large one-time payment, you can also use GCash—but make sure your account limit can handle the amount.

Alternatives to GCash for Paying MP2

If you don’t want to use GCash, here are other ways to pay Pag-IBIG MP2:

- Maya (Pay Bills section) – also charges a small fee.

- AUB via InstaPay – no login required, direct MP2 payment.

- BPI, Metrobank, Landbank, and other banks – either through online banking or over-the-counter.

- Over-the-Counter at Bayad Centers – for those who prefer physical payment.

FAQ Section

Q1: How long does it take for a GCash MP2 payment to reflect?

A1: Usually 1–2 business days. If it hasn’t reflected after that, double-check your MID and receipt.

Q2: Can I pay multiple MP2 accounts at once?

A2: No, each account must be paid separately. Make sure you have the correct MID for each account.

Q3: What if GCash doesn’t show Pag-IBIG under Bills?

A3: Try logging out and back in, or use the search function in the Bills section. Sometimes it’s temporarily hidden after app updates.

Q4: Is there a fee for paying MP2 via GCash?

A4: Generally, there is no fee if you pay directly through the Bills section. Avoid third-party apps to prevent extra charges.

Blogger’s Corner

Honestly, paying MP2 through GCash is the most convenient option for many Filipinos—lalo na kung busy ka and no time pumila sa bank.

The ₱5 service fee? Sulit na if you compare it to the time, pamasahe, and hassle na maiwasan mo. Pero, kung naglalagay ka ng malalaking lump sum (like ₱50,000 or ₱100,000 in one go), I recommend using a bank instead since mas safe and minsan mas mabilis mag-reflect.

Ako mismo, I usually pay monthly via GCash para hindi ko makalimutan. At least automatic habit siya. The important thing is consistent contributions, kasi in the end, that’s what makes your MP2 grow.