If you’re a Pag-IBIG member, your monthly contribution isn’t just a deduction from your salary—it’s an investment in your future. Starting 2024, Pag-IBIG increased the mandatory contribution rates, which means your savings will grow faster. In this guide, we’ll go … Continue reading

Tag Archives: Posts

Retirement Savings Strategies for Filipinos

Retirement is a period that many Filipinos either look forward to or dread to happen. I guess it all depends on how well-prepared you are when that time comes. Hence, it’s imperative to plan ahead and consider various financial factors … Continue reading

Maximizing Your Savings: What You Need to Know About Pag-IBIG MP2

Curious about Pag-IBIG MP2? Then you’re on the right page since we’ll discuss some of the most frequently asked questions about Pag-IBIG MP2 here. FAQs about Pag-IBIG MP2 Is Pag-IBIG MP2 a good investment? Yes, Pag-IBIG MP2 is widely regarded … Continue reading

Savings vs Investment: Which Approach is Right for You?

One of the key questions people often ask is, “Should I be saving or investing my money?” The answer is not always clear cut and there are pros and cons to both. In this post, we’ll explore the difference between … Continue reading

How to Choose the Right Investments for Your Financial Goals

Investing is a great way to grow your wealth and secure your financial future. Whether you’re looking to save for retirement, purchase a new home, or just grow your savings, there are a variety of investment options available to help … Continue reading

How to Start Investing: Tips for Beginners

With the right knowledge of your financial objectives, risk tolerance, and overall financial condition, investing can be a terrific strategy to gradually increase your wealth. Here’s what you need to know to get started: Create a Budget The amount you … Continue reading

Investing for Beginners: How to Get Started

Investing is an essential tool for achieving your financial goals, whether it’s buying a house, saving for retirement, or starting a business. But for many people, the world of investing can seem overwhelming and confusing. With so many different options … Continue reading

Why Filipinos Struggle with Saving and How to Overcome

As discussed in a previous post, savings are crucial because they allow you to build a financial cushion for emergencies, such as job loss or unexpected expenses. In addition, saving can help you achieve your long-term financial goals, such as … Continue reading

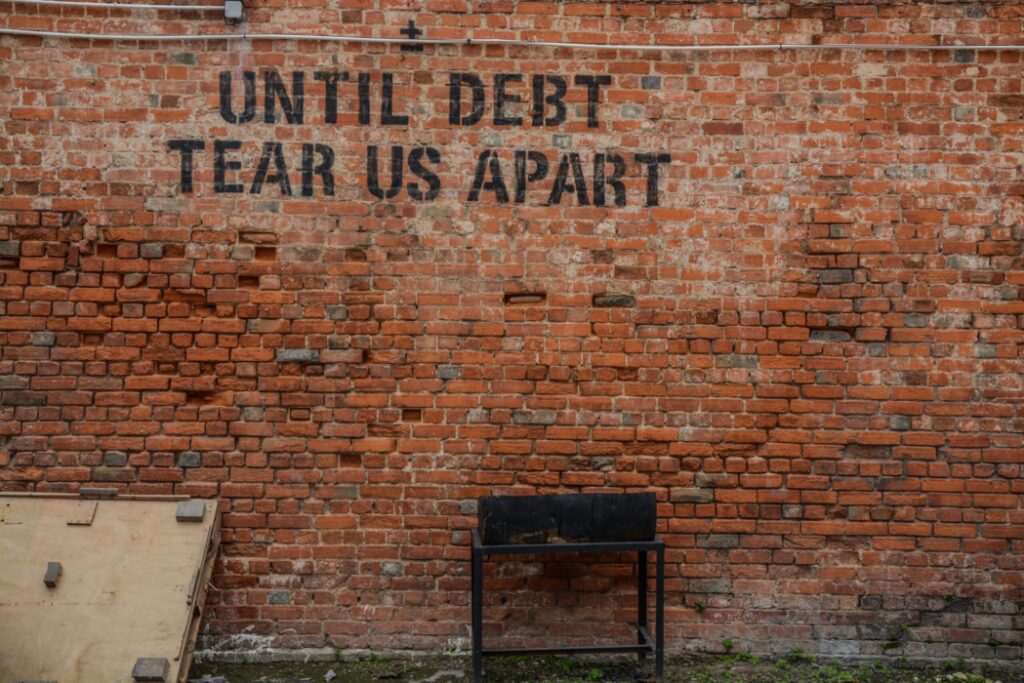

Practical Ways to Pay Off Your Ballooned Credit Card Debt

Credit card debt is a common problem for many Filipinos. Ballooning debt is when the minimum payment is not enough to cover the interest, and the balance keeps increasing. This can quickly lead to a situation where the debt becomes … Continue reading

Which Comes First: Paying Off Debt or Building Wealth?

Should you start paying off debt first or building wealth (investing) instead? Many would say that you need to pay off debts first before actually building wealth. As for me, I’d say that there is no straightforward answer. It all … Continue reading