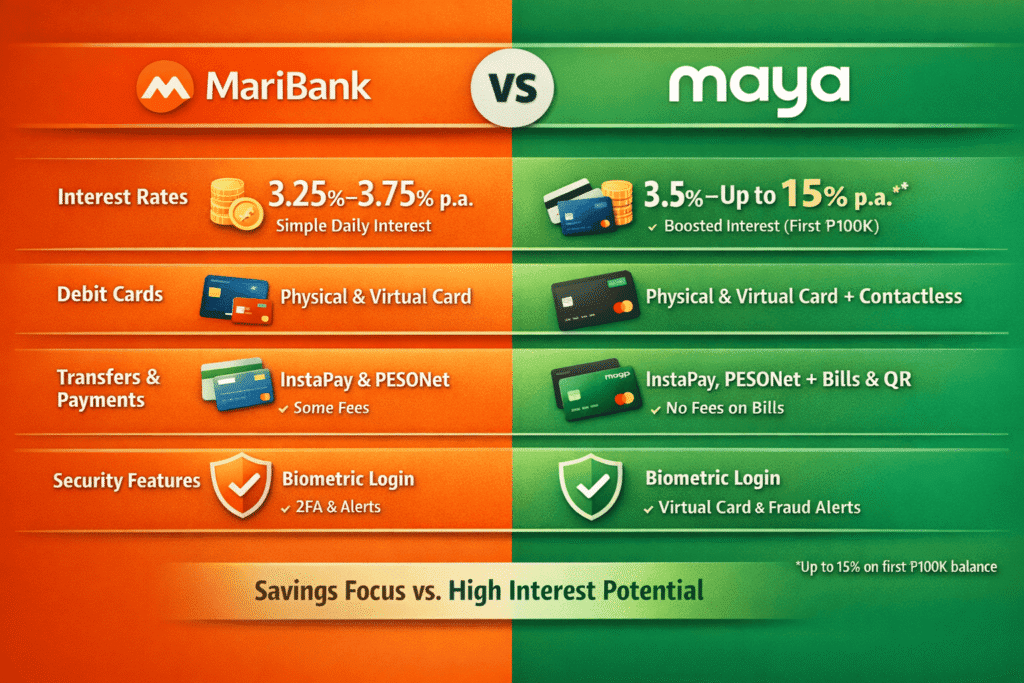

Digital banking in the Philippines has grown rapidly, giving Filipinos more ways to save, spend, and earn interest on their money. Two of the most popular options today are MariBank and Maya Bank. But if we focus purely on banking … Continue reading

Category Archives: High-Yield Savings Accounts

Complete List of Digital Banks in the Philippines (2026 Update)

Introduction Digital banking in the Philippines has grown tremendously over the past few years. From high-interest savings accounts to cashless payments, digital banks offer convenience that traditional banks just can’t match. If you’re looking for the best digital bank for … Continue reading

Salmon Bank Philippines: Interest Rates, Time Deposits, and Is It Worth It?

If you’ve been seeing Salmon Bank pop up in ads or finance discussions lately, you’re not alone. The bank has been aggressively marketing its high-interest time deposits, which are noticeably higher than what traditional banks offer. But what exactly is … Continue reading

MariBank Lowers Savings Interest Rate Starting January 15, 2026

If you’re keeping your emergency fund or idle cash in MariBank, you may want to take note. The digital bank is set to lower its savings interest rates starting January 15, 2026, based on reports from users who received in-app … Continue reading

Dividend Stocks vs MP2 vs Digital Savings: Comparing Real Returns

Trying to figure out the best way to grow your money safely—or at least smarter than just leaving it in your wallet? If you’ve been considering dividend stocks, Pag-IBIG MP2, or digital savings accounts, you might be wondering which gives … Continue reading

Maya Savings vs MP2: Which Is Better for Filipinos?

When choosing where to place excess cash, many Filipinos end up deciding between Maya Savings and Pag-IBIG MP2. At first glance, Maya looks more attractive because of its high advertised interest rate. MP2, on the other hand, does not promise … Continue reading

CIMB Bank Reduces Free InstaPay Transfers: Here’s What You Need to Know (2025 Update)

For years, CIMB Bank has been one of the most popular digital banks in the Philippines—mainly because of its high interest rates and free InstaPay transfers. But as of September 5, 2025, the bank has quietly updated its policy, and … Continue reading

Philippine Inflation 2025: How It Impacts Your Savings and Investments

Inflation in the Philippines has always been a hot topic, and in 2025, it’s once again front and center. For ordinary Filipinos, inflation simply means that your peso today buys you less tomorrow. Whether you’re saving money in the bank, … Continue reading

How to Maximize Maya Funds for Savings and Investments

When Maya (formerly PayMaya) rebranded itself as a digital bank and wallet, it quickly became one of the most popular fintech apps in the Philippines. Many Filipinos now use Maya not just for payments, but also as a platform for … Continue reading

The Rise of E-Wallet Banking in the Philippines (2025 Update)

E-wallets in the Philippines have come a long way. What started as simple apps for sending money and paying bills has now grown into full-fledged digital banks. In 2025, platforms like GCash, Maya, Maribank (formerly SeaBank), GoTyme, and Tonik are … Continue reading