Paying your Modified Pag-IBIG 2 (MP2) Savings Program contributions online is now easier than ever. Members of the Home Development Mutual Fund (Philippines) can choose from several digital payment channels depending on convenience and preference. Whether you prefer e-wallets, bank … Continue reading

Category Archives: Pag-IBIG (MP2, Savings, Housing Loan)

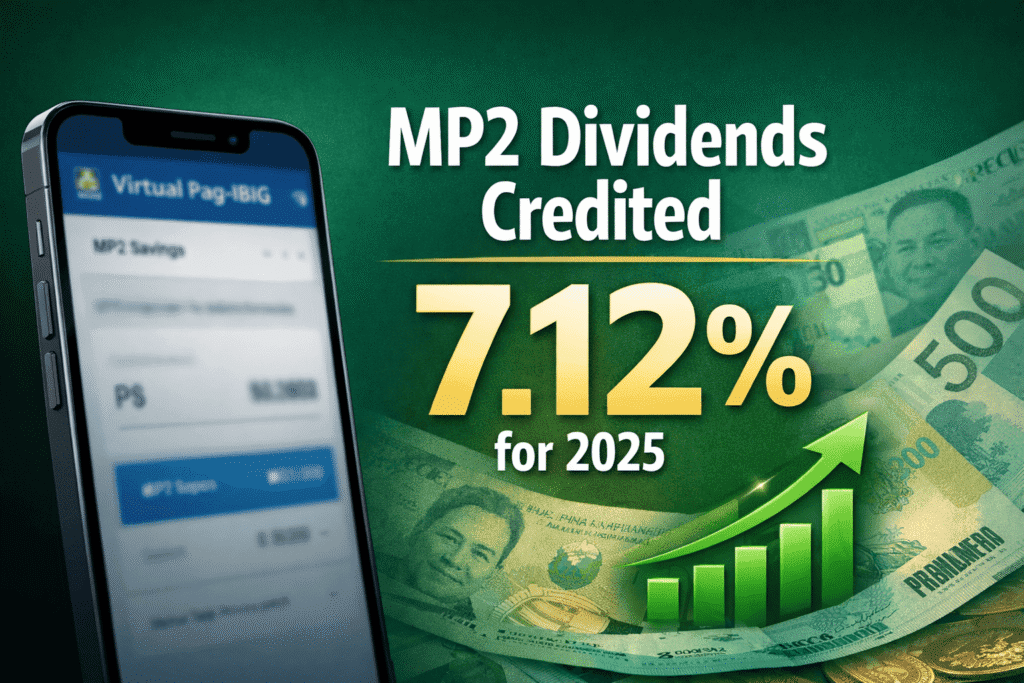

2025 Pag-IBIG MP2 Dividends Credited: How to Check Your Earnings Now

Good news for Pag-IBIG MP2 savers — the 2025 dividends have been officially declared and are now in the process of being credited to member accounts. Many members have started seeing their 7.12% dividend earnings reflected in Virtual Pag-IBIG, while … Continue reading

How to Check Your Home Development Mutual Fund (Philippines) Dividends Online (Step-by-Step Guide)

If you are a member of the Home Development Mutual Fund (Philippines) (Pag-IBIG Fund), it is important to monitor how your savings are growing over time. You can check your dividend records online through: What Are Pag-IBIG Dividends? Pag-IBIG dividends … Continue reading

Topping Pag-IBIG Regular Savings: Is Voluntary Top-Up Worth It?

For many members of the Home Development Mutual Fund (Pag-IBIG Fund), regular contribution is already part of monthly payroll deduction. But some members choose to add voluntary savings by topping up their regular contribution. The question is simple: 👉 Is … Continue reading

Pag-IBIG Dividend Rates for 2025 (Official) — Record Returns for Members!

Pag-IBIG Fund has officially announced the dividend rates for 2025 — and once again, members are getting strong, tax-free returns. If you’re contributing to Pag-IBIG Regular Savings or investing in MP2, here are the confirmed numbers you need to know. … Continue reading

How to Create a Pag-IBIG MP2 Account Online (Step-by-Step Guide)

Opening a Pag-IBIG MP2 account is still one of the easiest ways for Filipinos to start investing in a government-backed savings program. The enrollment process remains fully online through the official Pag-IBIG Fund MP2 portal, and you can complete it … Continue reading

Pag-IBIG Virtual Account Locked? Here’s How to Recover It

If you’ve tried logging in to your Virtual Pag-IBIG account recently and got locked out, you’re not alone. This happens to many members due to multiple failed login attempts, inactivity, or security measures. The good news is that recovering your … Continue reading

How to Pay Pag-IBIG MP2 Using Maribank: Complete Step-by-Step Guide

Paying your Pag-IBIG MP2 contribution using Maribank is still possible in 2026, and the process remains largely the same. This guide walks you through the step-by-step method of paying MP2 via Virtual Pag-IBIG using QR PH, making it a convenient … Continue reading

How to Pay Pag-IBIG MP2 Using a Credit Card via Bayad.com

If you’re contributing to Pag-IBIG MP2, you might already know that paying via the Virtual Pag-IBIG website comes with a 1.75% credit card convenience fee. That can add up quickly if you’re making a large deposit. Good news: Bayad.com (Bayad … Continue reading

Pag-IBIG MP2 Ladderized Strategy: A Smarter Way to Invest in MP2

If you want to invest in Pag-IBIG MP2 but don’t like the idea of locking all your money for five years at once, the ladderized MP2 strategy might be exactly what you’re looking for. This strategy is popular among conservative … Continue reading