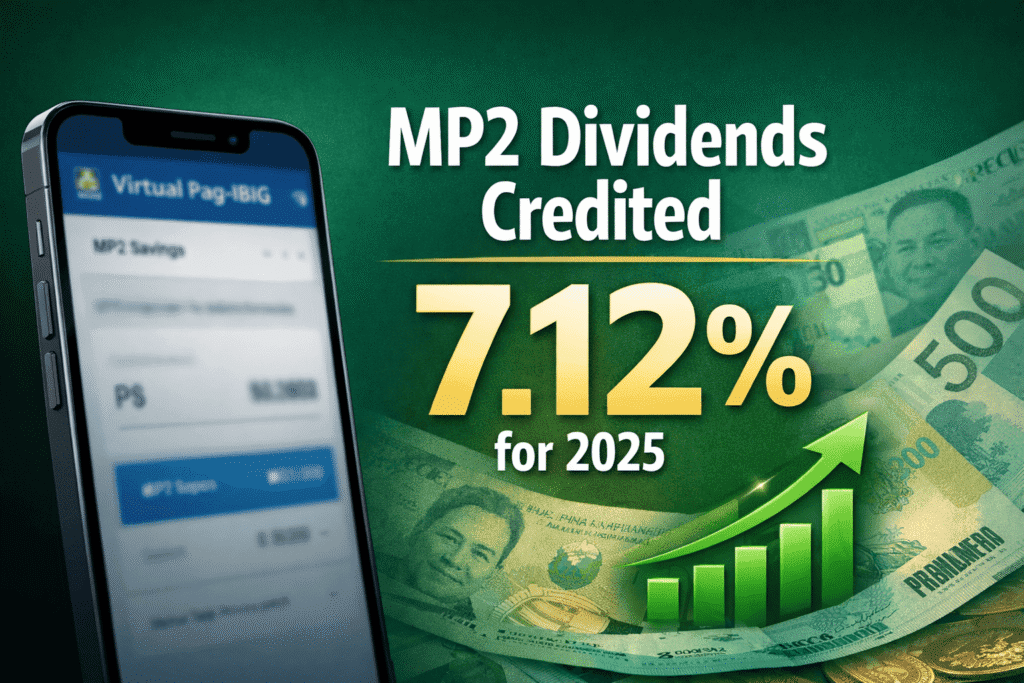

Good news for Pag-IBIG MP2 savers — the 2025 dividends have been officially declared and are now in the process of being credited to member accounts. Many members have started seeing their 7.12% dividend earnings reflected in Virtual Pag-IBIG, while … Continue reading

Tag Archives: Pag-IBIG MP2

How to Create a Pag-IBIG MP2 Account Online (Step-by-Step Guide)

Opening a Pag-IBIG MP2 account is still one of the easiest ways for Filipinos to start investing in a government-backed savings program. The enrollment process remains fully online through the official Pag-IBIG Fund MP2 portal, and you can complete it … Continue reading

How to Pay Pag-IBIG MP2 Using Maribank: Complete Step-by-Step Guide

Paying your Pag-IBIG MP2 contribution using Maribank is still possible in 2026, and the process remains largely the same. This guide walks you through the step-by-step method of paying MP2 via Virtual Pag-IBIG using QR PH, making it a convenient … Continue reading

How to Pay Pag-IBIG MP2 Using a Credit Card via Bayad.com

If you’re contributing to Pag-IBIG MP2, you might already know that paying via the Virtual Pag-IBIG website comes with a 1.75% credit card convenience fee. That can add up quickly if you’re making a large deposit. Good news: Bayad.com (Bayad … Continue reading

Pag-IBIG MP2 Ladderized Strategy: A Smarter Way to Invest in MP2

If you want to invest in Pag-IBIG MP2 but don’t like the idea of locking all your money for five years at once, the ladderized MP2 strategy might be exactly what you’re looking for. This strategy is popular among conservative … Continue reading

Complete List of Digital Banks in the Philippines (2026 Update)

Introduction Digital banking in the Philippines has grown tremendously over the past few years. From high-interest savings accounts to cashless payments, digital banks offer convenience that traditional banks just can’t match. If you’re looking for the best digital bank for … Continue reading

How to Check Your Pag-IBIG MP2 Information via the eGovPH App

Managing your Pag-IBIG MP2 account just got a whole lot easier. Thanks to the eGovPH app, you can now check your MP2 contributions, dividends, and balances anytime, anywhere, without having to line up at a Pag-IBIG branch. In this guide, … Continue reading

Why VUL Is Still Being Sold Despite Underperforming Almost Everything

The 2025 Reality Check If you have talked to a financial advisor in the Philippines, chances are you were pitched a VUL. Not MP2. Not index funds. Not even a basic term insurance plan. A VUL. And yet, the data … Continue reading

Can the Government Touch Pag-IBIG Funds? Why a PhilHealth-Style Scandal Is Unlikely

With corruption scandals dominating the news, from PhilHealth fund misuse to questionable flood control spending, many Filipinos are asking a reasonable question: Can Pag-IBIG suffer the same fate? More specifically, if the government is desperate for money, can the President … Continue reading

Dividend Stocks vs MP2 vs Digital Savings: Comparing Real Returns

Trying to figure out the best way to grow your money safely—or at least smarter than just leaving it in your wallet? If you’ve been considering dividend stocks, Pag-IBIG MP2, or digital savings accounts, you might be wondering which gives … Continue reading