Opening a Pag-IBIG MP2 account is still one of the easiest ways for Filipinos to start investing in a government-backed savings program. The enrollment process remains fully online through the official Pag-IBIG Fund MP2 portal, and you can complete it … Continue reading

Category Archives: Featured

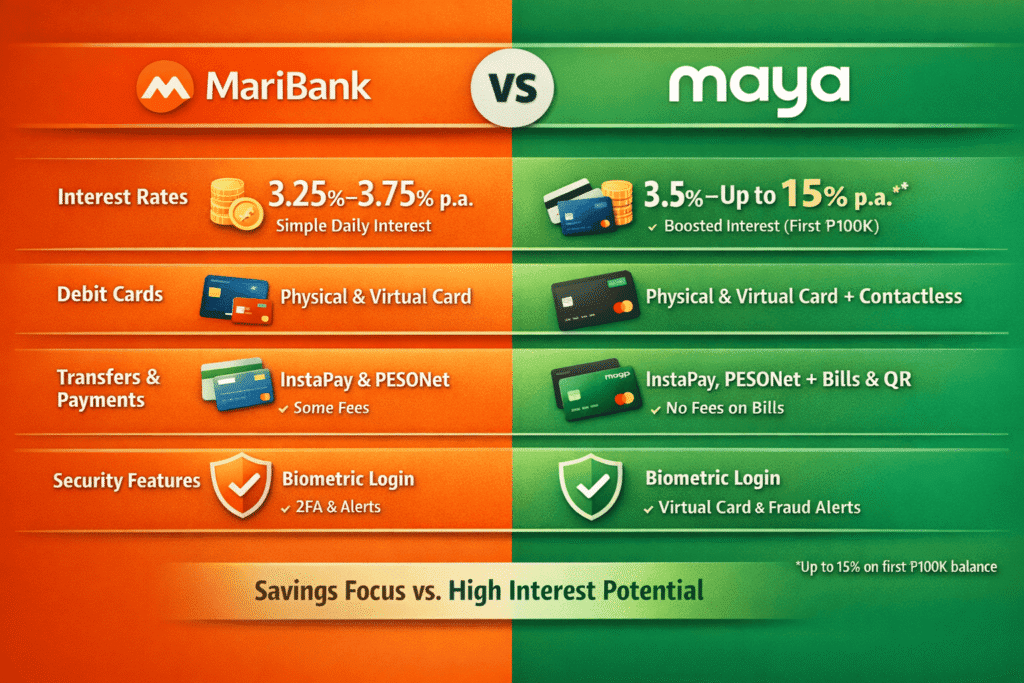

MariBank vs Maya: Which Digital Bank is Better for Your Money in 2026?

Digital banking in the Philippines has grown rapidly, giving Filipinos more ways to save, spend, and earn interest on their money. Two of the most popular options today are MariBank and Maya Bank. But if we focus purely on banking … Continue reading

How to Pay Pag-IBIG MP2 Using GCash (2026 Updated + Troubleshooting Tips)

Paying your Pag-IBIG MP2 contributions on time is super important if you want to maximize your savings and earn those dividends. Good news: you don’t have to line up at a branch anymore! With digital wallets like GCash, you can … Continue reading

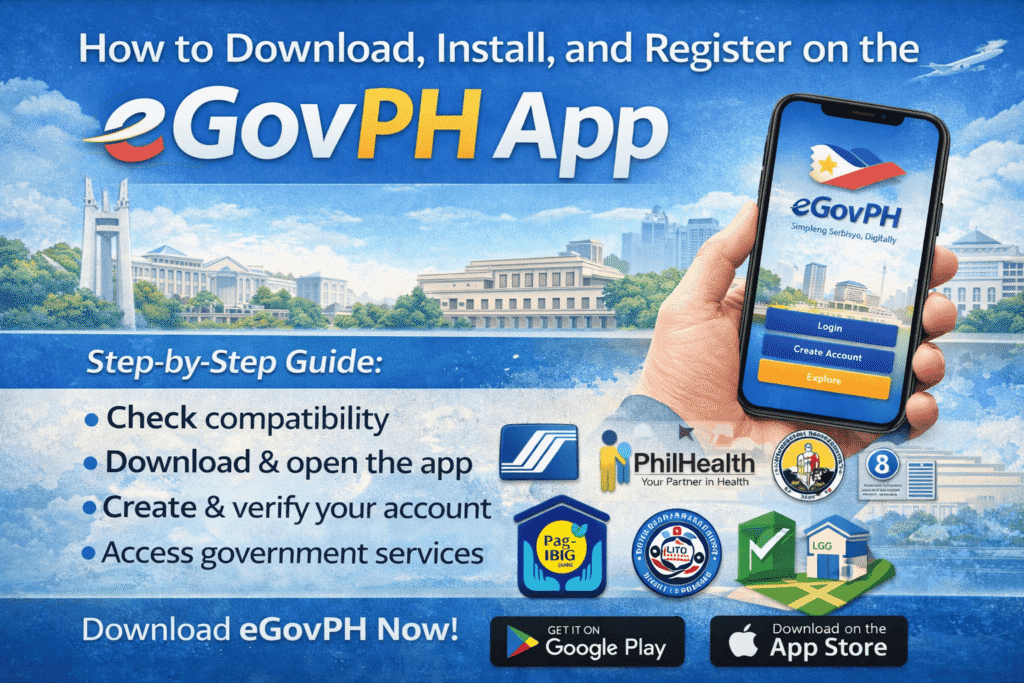

How to Download, Install, and Register on the eGovPH App

Accessing government services has never been easier, thanks to the eGovPH app. From checking your SSS contributions to handling Pag-IBIG transactions, this app brings multiple government services right to your smartphone. If you’re new to the app, don’t worry! Here’s … Continue reading

eGovPH App: Your Guide to Accessing Philippine Government Services Online

In today’s digital world, government transactions don’t have to be stressful or time-consuming. Enter the eGovPH app—a government initiative aimed at making public services more accessible right from your smartphone. Whether you’re applying for IDs, checking your tax status, or … Continue reading

SCHD Is Being Left Behind — And Dividend Investors Are Paying the Price

SCHD (Schwab U.S. Dividend Equity ETF) used to be untouchable in dividend circles. Low expense ratio.Quarterly income.“Sleep well at night” investing. But let’s stop pretending nothing has changed. SCHD is no longer just underperforming. It’s falling behind — badly.And the … Continue reading

Pag‑IBIG Forms You Need (2025 Guide): Commonly Used Documents and Where to Download Them

Whether you’re applying for a Pag-IBIG loan, enrolling in the MP2 program, or making changes to your membership record, you’ll need to fill out the right form. To make things easier, here’s a quick reference guide to the most commonly … Continue reading

AI Bubble 2025: Why Regulators Are Sounding the Alarm

In 2025, the hype around Artificial Intelligence (AI) has reached fever pitch. With massive investments, surging valuations of tech firms, and a wave of speculative betting, major financial institutions and central banks are now raising red flags: the AI boom … Continue reading

Bitcoin Crash 2025 Explained: Causes, Consequences, and What’s Next

After a strong run earlier this year, Bitcoin suddenly plunged by more than 8% in a single day—its steepest drop since 2022. The broader crypto market lost nearly $19 billion in value as leveraged positions were wiped out and panic … Continue reading

Is the Philippine Party-List System a Waste of Taxpayers’ Money?

The Philippine party-list system was supposed to give a voice to the marginalized. But more than two decades after its implementation, one can’t help but ask: is it really serving its purpose—or is it just another way to waste taxpayers’ … Continue reading