If you’re keeping your emergency fund or idle cash in MariBank, you may want to take note. The digital bank is set to lower its savings interest rates starting January 15, 2026, based on reports from users who received in-app … Continue reading

Author Archives: Kuya Well

How to Check Your Pag-IBIG MP2 Information via the eGovPH App

Managing your Pag-IBIG MP2 account just got a whole lot easier. Thanks to the eGovPH app, you can now check your MP2 contributions, dividends, and balances anytime, anywhere, without having to line up at a Pag-IBIG branch. In this guide, … Continue reading

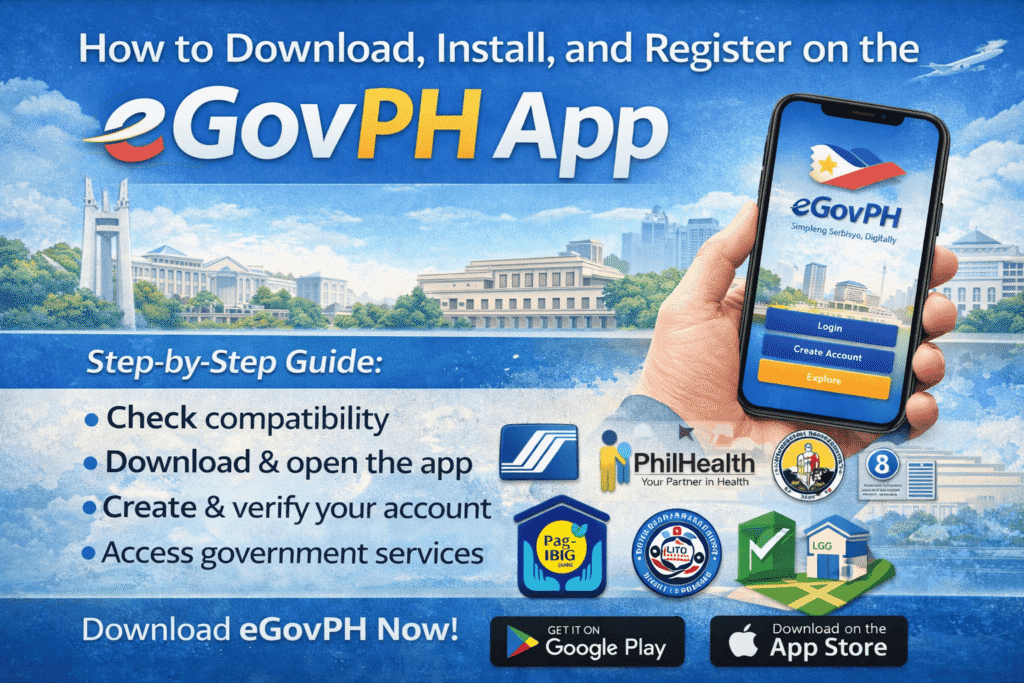

How to Download, Install, and Register on the eGovPH App

Accessing government services has never been easier, thanks to the eGovPH app. From checking your SSS contributions to handling Pag-IBIG transactions, this app brings multiple government services right to your smartphone. If you’re new to the app, don’t worry! Here’s … Continue reading

eGovPH App: Your Guide to Accessing Philippine Government Services Online

In today’s digital world, government transactions don’t have to be stressful or time-consuming. Enter the eGovPH app—a government initiative aimed at making public services more accessible right from your smartphone. Whether you’re applying for IDs, checking your tax status, or … Continue reading

GoCrypto by GoTyme: A Beginner’s Guide to Buying and Selling Crypto in the Philippines

Cryptocurrency has been making waves in the Philippines, and several platforms have emerged to make buying and selling crypto easier. One of the newer players in the market is GoCrypto, a service offered by GoTyme Bank. Whether you’re a first-time … Continue reading

NTC Blocks Multiple Crypto Exchanges in the Philippines: What Investors Need to Know

The Philippine crypto space was shaken recently after reports confirmed that the National Telecommunications Commission (NTC) ordered local internet service providers to block access to multiple cryptocurrency exchanges. Some of the platforms affected are globally recognized exchanges used by millions … Continue reading

How to Pay Pag-IBIG MP2 Using Maribank: Complete Step-by-Step Guide

Maribank is becoming one of the go-to digital banks for Filipinos because transfers are smooth, interest rates are competitive, and the app gives up to 15 free InstaPay transactions per week. But here’s one limitation: even though Maribank has a … Continue reading

VOO ETF: Why Investors Choose the S&P 500

If you’re exploring ETFs or looking for diversified exposure to the U.S. stock market, you’ve probably come across VOO—the Vanguard S&P 500 ETF. But what exactly is it, and why do investors favor it? Let’s break it down. What is … Continue reading

Why VUL Is Still Being Sold Despite Underperforming Almost Everything

The 2025 Reality Check If you have talked to a financial advisor in the Philippines, chances are you were pitched a VUL. Not MP2. Not index funds. Not even a basic term insurance plan. A VUL. And yet, the data … Continue reading

Can the Government Touch Pag-IBIG Funds? Why a PhilHealth-Style Scandal Is Unlikely

With corruption scandals dominating the news, from PhilHealth fund misuse to questionable flood control spending, many Filipinos are asking a reasonable question: Can Pag-IBIG suffer the same fate? More specifically, if the government is desperate for money, can the President … Continue reading