Walk into almost any Filipino household and ask this simple question: “Do you have investments?” You’ll often hear no. But ask this instead: “Do you have insurance?” Suddenly, there’s a long list. VULs, endowment plans, riders, add-ons, and sometimes multiple … Continue reading

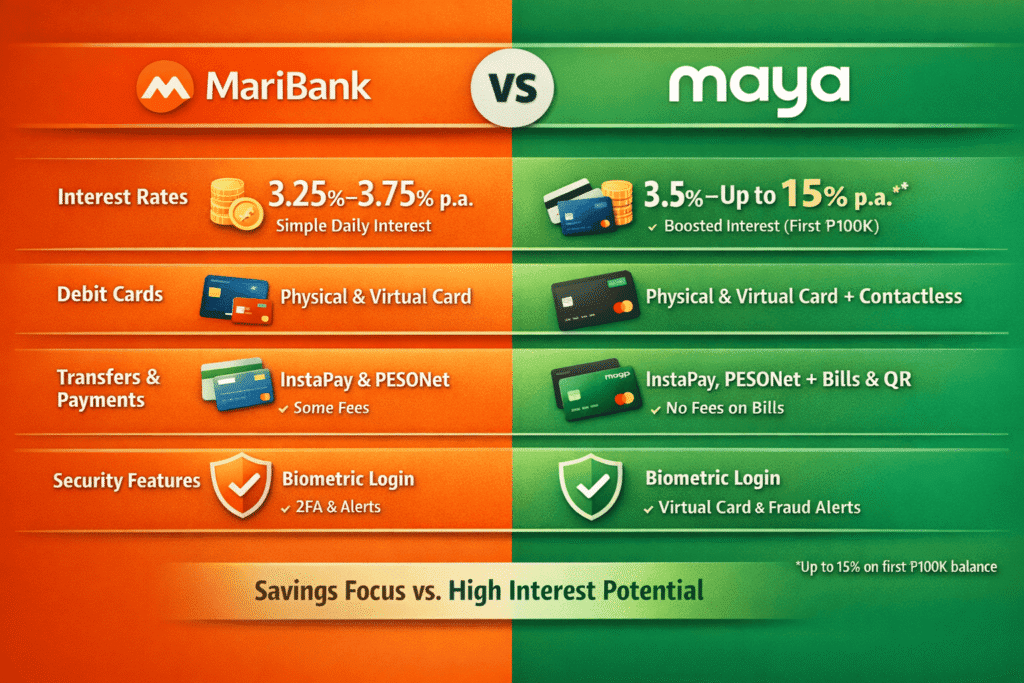

MariBank vs Maya: Which Digital Bank is Better for Your Money in 2026?

Digital banking in the Philippines has grown rapidly, giving Filipinos more ways to save, spend, and earn interest on their money. Two of the most popular options today are MariBank and Maya Bank. But if we focus purely on banking … Continue reading

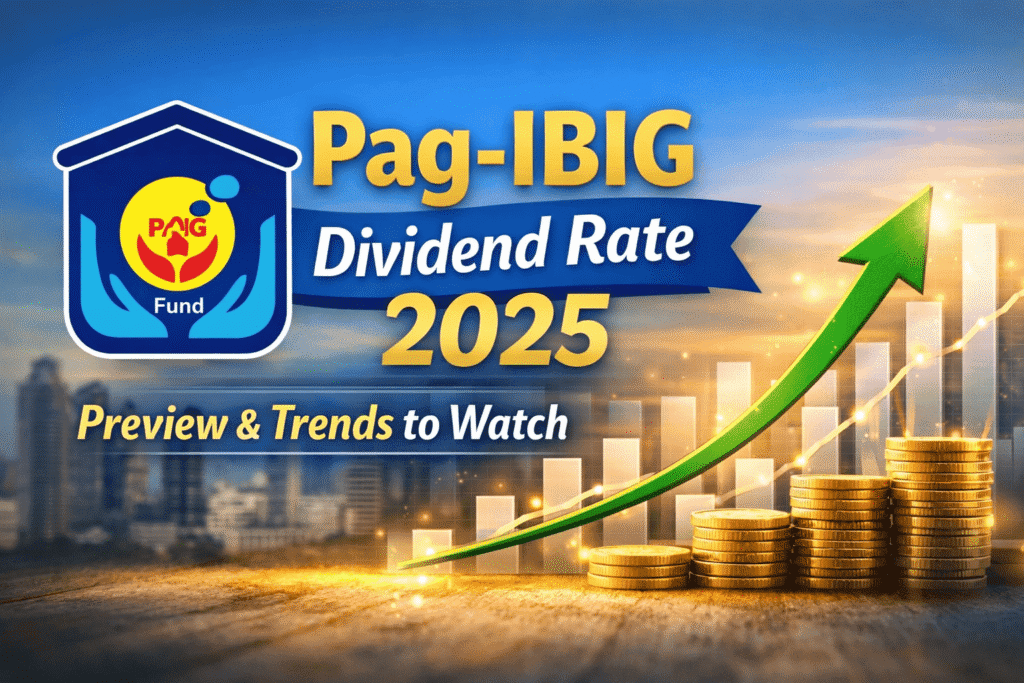

Pag-IBIG Dividend Rate 2025: What to Expect (Preview + Historical Trends)

If you’re a Pag-IBIG member or an MP2 investor, you know one of the most exciting parts of the year is the announcement of the annual dividend rate. It tells you how much your savings could grow — and helps … Continue reading

How to Pay Pag-IBIG MP2 Using Maribank: Complete Step-by-Step Guide

Paying your Pag-IBIG MP2 contribution using Maribank is still possible in 2026, and the process remains largely the same. This guide walks you through the step-by-step method of paying MP2 via Virtual Pag-IBIG using QR PH, making it a convenient … Continue reading

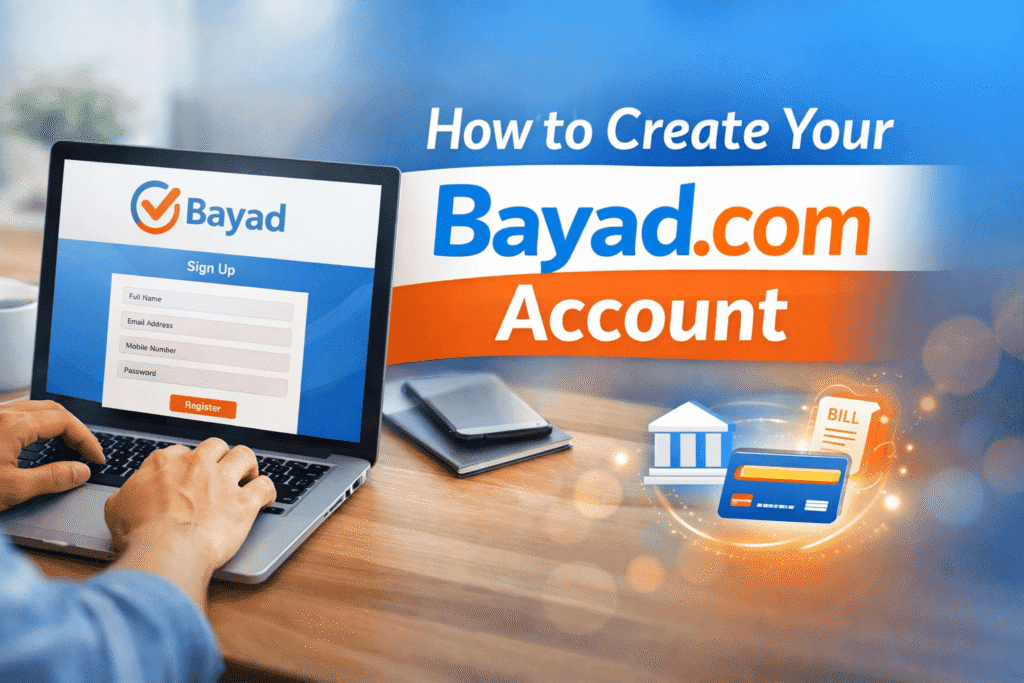

How to Create a Bayad.com Account: Step-by-Step Guide

Managing bills and payments online is easier than ever with Bayad.com, one of the Philippines’ most popular digital payment platforms. Whether you want to pay utilities, loans, or government fees, having a Bayad.com account makes your life hassle-free. In this … Continue reading

How to Pay Pag-IBIG MP2 Using a Credit Card via Bayad.com

If you’re contributing to Pag-IBIG MP2, you might already know that paying via the Virtual Pag-IBIG website comes with a 1.75% credit card convenience fee. That can add up quickly if you’re making a large deposit. Good news: Bayad.com (Bayad … Continue reading

Pag-IBIG MP2 Ladderized Strategy: A Smarter Way to Invest in MP2

If you want to invest in Pag-IBIG MP2 but don’t like the idea of locking all your money for five years at once, the ladderized MP2 strategy might be exactly what you’re looking for. This strategy is popular among conservative … Continue reading

Pag-IBIG Loyalty Card Plus Benefits (2026 Updated Guide)

The Pag-IBIG Loyalty Card Plus remains one of the most useful yet underrated benefits for Pag-IBIG Fund members in 2026. What started as a simple discount card has evolved into a multi-purpose Pag-IBIG ID, cash card, and savings tool—all for … Continue reading

What Is PERA? A Beginner’s Guide to the Philippines’ Personal Equity and Retirement Account

If you’re serious about retirement but feel like SSS, GSIS, or even Pag-IBIG MP2 won’t be enough, then it’s time you learn about PERA — the Personal Equity and Retirement Account. PERA is often called the Philippines’ version of the … Continue reading

Maya Black Credit Card: Features, Benefits, and Is It Worth It?

The idea of a “black card” has always been associated with exclusivity, high income requirements, and elite perks. Maya is changing that narrative with the Maya Black Credit Card—a digital-first, premium-looking credit card that promises rewards, travel perks, and app-based … Continue reading