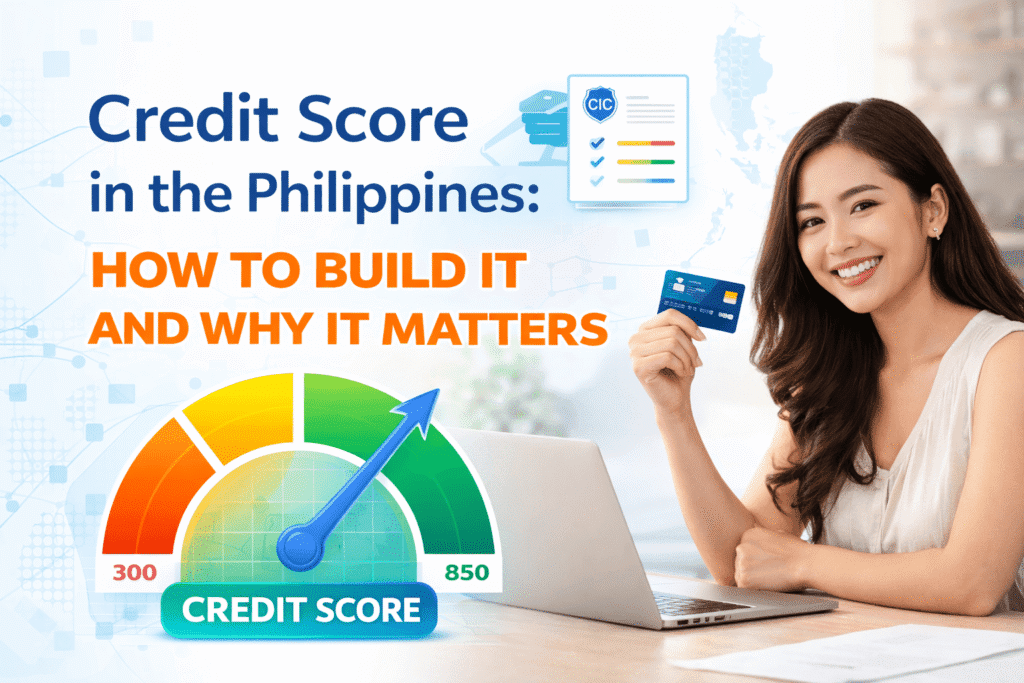

Your credit score is one of the most important numbers you’ll ever have — yet most Filipinos don’t even know it exists. Whether you’re planning to get a loan, apply for a credit card, or even rent a property, your … Continue reading

Tag Archives: personal finance philippines

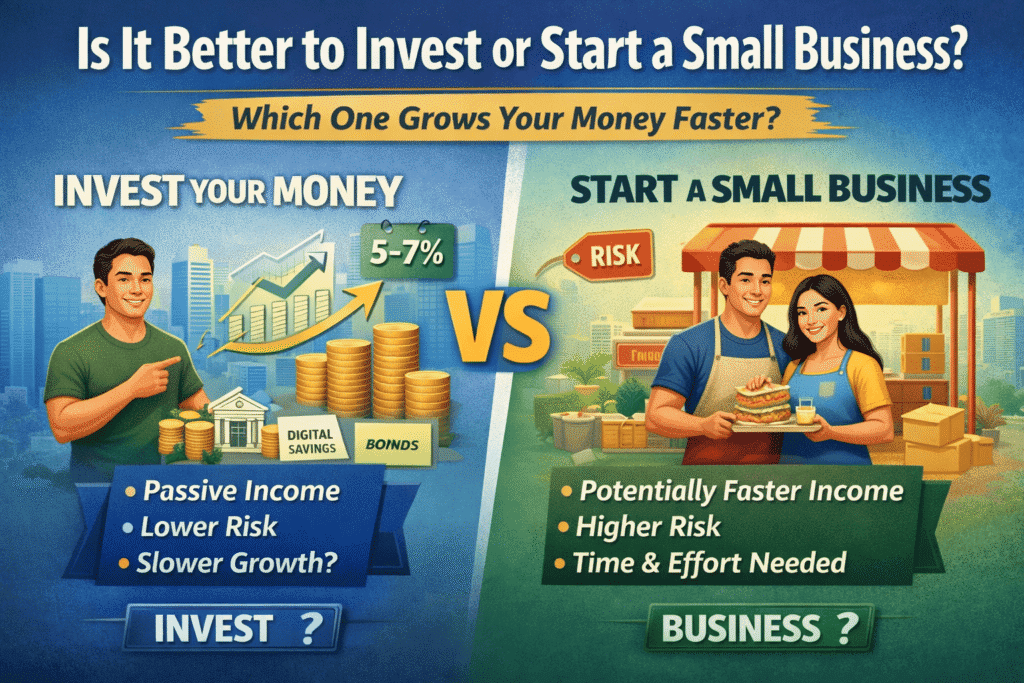

Is It Better to Invest or Start a Small Business?

One of the most common financial questions among Filipinos is this: Should you invest your money… or use it to start a small business? There is no universal answer. But there is a smarter way to think about it. Because … Continue reading

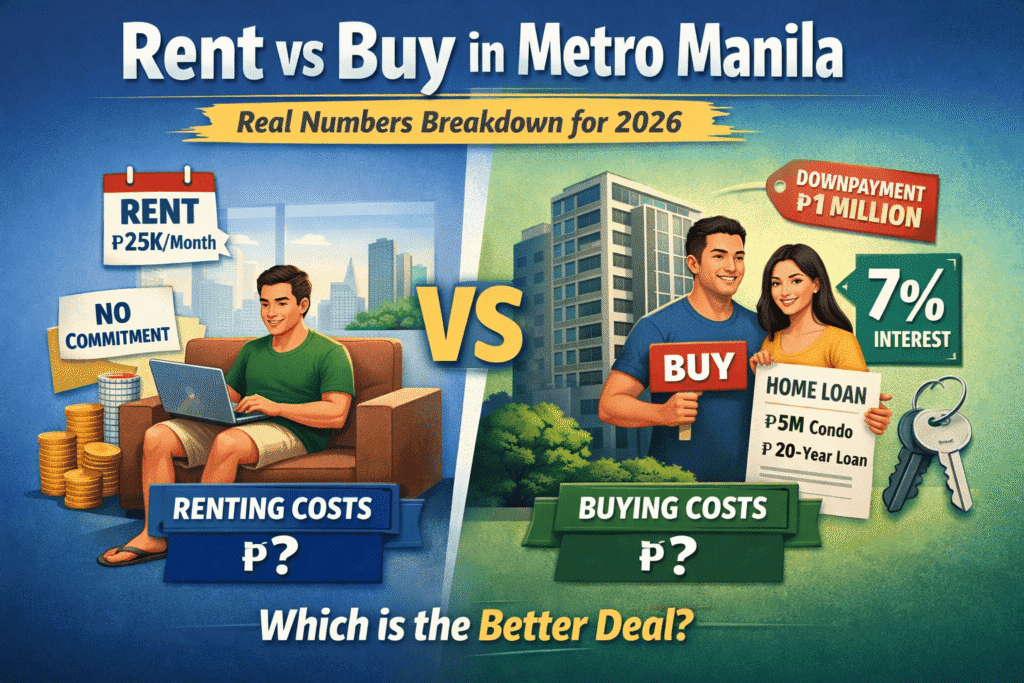

Rent vs Buy in Metro Manila (Real Numbers Breakdown for 2026)

If you’re living in Metro Manila, you’ve probably asked yourself this question: Should I keep renting… or finally buy a condo? With property prices still high and interest rates not exactly “cheap,” the decision isn’t as simple as older generations … Continue reading

Why Many Filipinos Are Over-Insured but Under-Invested

Walk into almost any Filipino household and ask this simple question: “Do you have investments?” You’ll often hear no. But ask this instead: “Do you have insurance?” Suddenly, there’s a long list. VULs, endowment plans, riders, add-ons, and sometimes multiple … Continue reading

How “Buy Now, Pay Later” Apps Are Changing Filipino Spending Habits

Buy Now, Pay Later apps, like LazadaPay Installments, Atome, and others, are changing the way Filipinos shop. They make it easy to buy things without paying the full amount upfront. But there is a growing concern. Are these apps encouraging … Continue reading

Should Retirees Invest in Pag-IBIG MP2? A Practical Look

Many retirees ask: “Should I put my retirement money in Pag-IBIG MP2?” The answer isn’t as simple as “yes.” While MP2 is safe and tax-free, at age 60+, your priorities are different: preserving capital, staying liquid for emergencies, and enjoying … Continue reading

Pag-IBIG MP2 for OFWs: How Overseas Filipinos Can Open and Contribute

If you’re an OFW looking for a safe and high-yield investment in the Philippines, the Pag-IBIG MP2 Savings Program is one of your best options. It’s government-backed, tax-free, and has been giving solid annual dividends — often higher than most … Continue reading

How Much You Need to Retire Comfortably in the Philippines

Retirement—it’s something many Filipinos dream about but rarely plan for. We often say “Bahala na si Batman” when it comes to our future, but the truth is, financial freedom after your working years doesn’t happen by accident. So, how much … Continue reading

How to Pay Down Your Pag-IBIG Housing Loan Faster (The Right Way to Pay to Principal)

Many Pag-IBIG housing loan borrowers dream of becoming debt-free sooner. The good news? There’s a legitimate way to shorten your loan term and save on interest—the “Pay to Principal” method. But here’s the catch: a lot of people misunderstand how … Continue reading

Philippine Inflation 2025: How It Impacts Your Savings and Investments

Inflation in the Philippines has always been a hot topic, and in 2025, it’s once again front and center. For ordinary Filipinos, inflation simply means that your peso today buys you less tomorrow. Whether you’re saving money in the bank, … Continue reading